Ahh, investing. As you probably can tell, investing is somewhat of a passion of mine. This website probably gives that away. My fascination with the topic really stems from the number of opportunities it can provide. Smart investing now can be very powerful and open many doors for you to navigate through your own financial journey. The idea of financial freedom through a little upfront work is very appealing to me, which is why I think others should start investing now. Unfortunately, not many share this view.

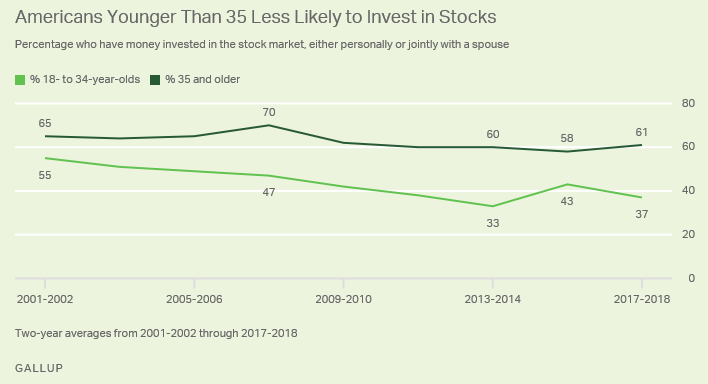

Since the 2008 Financial Crisis, young adults have stopped investing at an alarming rate. As of 2018, only 37% of people under the age of thirty-five were investing; this percentage was as high as 52% before the crash. Many young adults figure that there’s no need to start so early taking control of their finances when they have their whole life in front of them. I’d say that’s not the right mindset to have. In an attempt to change some of your minds, in this article, I’m going to dive into six reasons why you should start investing now!

1. The Earlier You Start, The Greater the Benefits

There’s a Chinese proverb that says: “The best time to plant a tree was 20 years ago. The second best time is now.” That is definitely the case when it comes to investing. If you start investing at a young age, you would reap greater benefits than if you had waited. Why exactly is it better to invest early? The answer is compound interest.

This is when you collect interest on your principal, reinvest your interest, collect even more interest, and then just keep repeating this process. In other words, compound interest is the interest you collect on interest. Let’s look at an example.

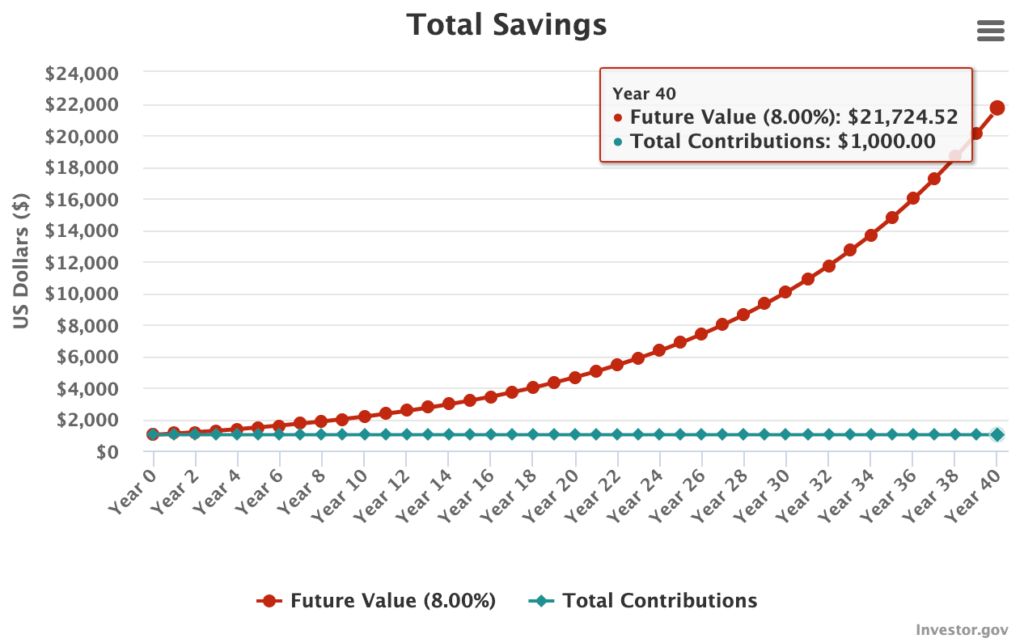

If you were to invest $1,000 for 40 years at an 8% return without reinvesting, you’d realize $3,200 in total gains. However, if you reinvested your gains over that time instead, that $1,000 would’ve grown into over $21,000. That return is over 6x greater than it would be if you had not reinvested. This is all assuming you don’t make any additional investments over that time either. If you continuously contribute, that $1,000 could grow into much more than $21,000. (To calculate the future value of an investment using compound interest, you can use a compound interest calculator. I have a lot more fun using these than I should if we’re being honest.)

Albert Einstein, a theoretical physicist with an IQ of over 160, once described compound interest as “the eighth wonder of the world.” I think this example shows just that. So, start your path to wealth by investing now!

2. Money Loses Its Value Over Time

People work very hard for their money. The last thing you would want is for that hard-earned money to lose its value. Unfortunately, that exactly happens if you don’t invest your money.

With every day that passes, your precious money goes down in value. That $1,000 that you may have stored under your mattress will not be the same $1,000 in a couple of years. As time goes on, prices of goods and services will continue to rise, which is known as inflation. This means that your money would have less buying power. This phenomenon is known as the time value of money (TVM).

On average, inflation usually is around 2%. This means that the value of the dollar will decrease in buying power by about 2% every year. However, as we’ve seen in 2022, inflation can be much greater than 2%, with current rates being over 8%. So, this only means that your hard-earned money is losing even more value than it did previously!

There are a number of ways to fight off the negative effects of inflation, with one of the most effective being investing. Since 1957, the S&P 500 has increased roughly 11% every year. In other words, the stock market has increased at a rate greater than normal rates of inflation and even 2022’s rate of inflation.

You may be wondering: “wouldn’t high inflation impact these publicly traded companies too?” To an extent, of course. High rates of inflation would have ripple effects on the whole economy. However, corporations navigate the economy (especially during a recession) very differently than individual people. Companies have the ability to raise the prices of their products and services, which would increase their sales numbers. Thus, their financials would be able to keep up with inflation.

Investing in the stock market ensures that your money does not lose value over time. In fact, it is a rather safe bet that your money will grow in the long term if held in stocks. Increasing the value of your money and beating inflation are great reasons to start investing now.

So, takeaway here: Do not just have your money sitting in a safe, collecting dust. The longer you wait to start, the more value your money will lose. So, why not start today?

3. Savings Accounts Are Terrible

I just touched on how money loses value over time and how the market could protect its value. As you read that, the thought of a savings account might have crossed your mind. From when we were children, we were taught that it was responsible financial behavior to put our money in a savings account. Based on what we learned, one might think a savings account would be a good way to beat inflation and see some return on investment. However, this is far from the truth.

According to CNN.com, the average annual return for a savings account is 0.06%. (Not 6%, .06%). So, for every year in a savings account, your deposit will grow less than one-tenth of a percent. For example, if you had $10,000 deposited in a savings account, you would gain just $6 in interest for the year. With that low of a return, your money still would lose value to inflation (2% inflation > .06% return).

Some banks have been offering higher interest rates, all upwards of 2%. This is becoming more common again, as the Federal Reserve continues to increase interest rates. However, if a bank offers a 2.5% interest rate and the inflation rate is 2%, your real return would be only 0.5% (2.5% less 2%). This is very small especially compared to the return you would receive from the stock market.

As mentioned before, the return of the S&P 500 is roughly 11% over the last 65 years. If you had invested that $10,000 in an S&P 500 index fund instead of putting it in a savings account, you would have realized $1,100 in gains. This return is over 180 times greater than the average interest from a savings account. (Just think how that could compound over time!)

In investing, there is no ceiling on possible returns, while savings accounts fix the return at a predetermined rate. With that said, savings accounts definitely have their purposes, such as for an emergency fund. However, at the end of the day, savings accounts are meant for preserving wealth, not creating it. And, if you are young or just getting started on your personal finance journey, it probably isn’t best to try using savings accounts for huge returns.

You should do something smart with your money, and relying on a savings account is not that. Look to invest, and take advantage of a tremendous financial opportunity.

4. It’s Your First Form of Passive Income

As noted earlier, people do work hard for their money. They go to their job, spend around eight or more hours working, then go home to repeat the cycle all over again the next day. This routine is considered active income, where your time is exchanged for money.

Active income is not the only way to earn money; there is also passive income, which does not require physical labor. An example of this would be receiving rental income from a property. Here, you would not have to exchange your time for money. Instead, your investment is earning the money on its own.

Passive income makes your money work for you and not the other way around. After some time, your passive income can be so significant that you might not have to work as much as you once did. Your passive income could even surpass your active income, which could provide you with financial freedom.

Investing in the stock market is a form of passive income, a great one at that. Returns on stock gains and dividend payments are income sources with no physical work required. The best part is that this is simple to start, which I will touch on in my next point.

Getting to a point of significant passive income will take patience. But, when that point comes, it will be well worth it!

5. We Are in a Golden Age of Investing

Many people are discouraged from investing because they think they need a lot of money or that it’s too difficult to start. This can’t be further from the truth.

Ever since brokerage Robinhood hit the scene, the entire financial world has changed. Today, brokerage platforms continuously lower the barrier to entry for new investors. In other words, investing has never been easier to start! Here are the main ways that investing has become more accessible:

No Brokerage Fees. Most platforms today no longer charge brokerage fees for trades. Before a few years ago, brokerages would charge anywhere from $3 to $7 for every transaction. These little fees would definitely add up over time. So, removing them is definitely a significant source of cost savings.

No Account Minimums. Additionally, many of these platforms do not require account minimums anymore. This means that you do not need a lump sum of money to open a brokerage account anymore.

Fractional Shares. Further, fractional shares are now commonplace on most brokerage platforms. Fractional shares allow individuals to invest in large companies for as little as $1. For example, if Apple’s stock were worth $100/share, you could buy 1/100 of a share for $1. With these new initiatives, your dollar has never had more value when it comes to investing.

Signup Rewards. Some brokerages also are offering signup rewards for new members. Brokerages have been offering free stock for those opening accounts on their platform. This can serve as a perfect kickstart for someone’s investing journey.

Today, brokerages have made investing more beginner-friendly than ever before. So, now is a better time than ever to start dabbling in investing!

6. You Have to Be In It to Win It

For those who do not fully understand the market, there might be some fear in investing. Between the amount of money at play and the perceived complexity of the market, one may be nervous to even start. My last point showed how easy it is to start now. So, there is absolutely nothing to fear. Stocks do not just lose all of their value in a single night (hopefully), nor do they double in value. With a basic understanding of a company, one can make an educated judgment on whether or not to invest.

With this in mind, you have to be in the stock market to reap the rewards. I mentioned before that stocks can have limitless growth potential. There’s no way to benefit from this if you are not invested in the market. An example of this is when Apple co-founder Ronald Wayne sold his 10% stake in the company in 1976 for $800. That 10% is now worth around $90,000,000,000, or 112,499,999 times the original investment. Because he sold his stake in Apple so early, he was unable to benefit from the company’s long-term success.

Investing is a long-term game, and you have to be patient and stay in the market to succeed. Selling too early or not investing at all due to fear will cause you to never see positive returns in the market. You need to be in it to win it, and the only way to create a secure financial future for yourself is to start investing now!

Comments

One response to “Six Reasons to Start Investing Now!”

Exactly.