According to the United States Federal Reserve, about 40% of Americans would be unable to cover a $400 emergency expense. In other words, two out of five people do not have enough savings to afford $400 at a moment’s notice. What does this mean? Well, a significant amount of Americans are one unexpected expense away from complete financial ruin. This is unsettling, to say the least, and something needs to be done to properly prepare individuals for any financial obstacle that life throws at them. Thankfully, there is a way for people to avoid such a situation altogether, and that is through the construction of an emergency fund.

Vanguard defines an emergency fund as a pool of savings with the sole purpose of covering financial emergencies. These emergencies can include job loss, a medical emergency, necessary home repairs, car troubles, and unplanned travel expenses. It needs to be noted that these accounts are not used for discretionary purchases. You should never dip into your emergency fund to pay for clothes, to go out to eat, etc. These are not actual emergencies, and the savings in your emergency fund should be used in the case of an emergency only.

Why an Emergency Fund is Necessary

I’m sure that at least one reader will think that they will never need an emergency fund. They might think that they make a great enough salary or income to cover an emergency once it arises. While this could be the case in some instances, this line of thinking can be dangerous for your personal finances. Emergencies typically happen suddenly and without notice. Thus, if you have not prepared for an emergency beforehand, you are likely to be blindsided if one were to occur.

In a given month, you are likely allocating all of your income. You will split it between investments, normal recurring expenses, paying debts, and discretionary purchases. If you do not account for emergencies ahead of time, you are likely not going to be able to afford them when they do occur. As a result, you become part of the 40% of Americans that cannot afford a $400 unexpected expense. Without an emergency fund, you will have to adjust your entire budget and consequently your lifestyle to pay this expense.

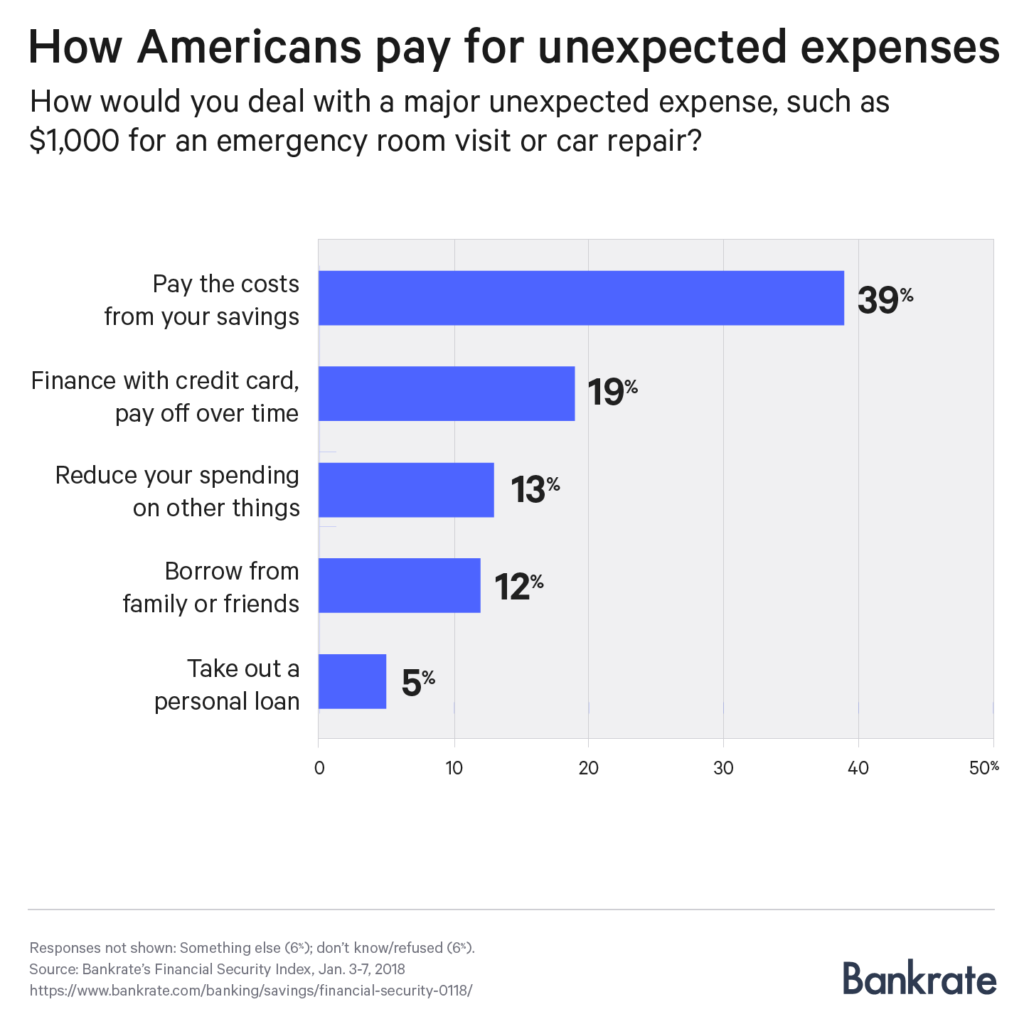

In this case, you may have to sacrifice some areas of spending to cover this emergency expense. Maybe you have to live significantly below your means, not being able to go out and enjoy the company of friends and family. Or, even worse, you may have to neglect your monthly investments or dip into your personal savings to make these payments. In the United States, 39% of adults would pay a $1,000 unexpected emergency with personal savings. In this case, a financial emergency would not affect you just in the short term. Rather, it would have long-term ramifications, as it could delay your retirement or make you financially insecure. This illustrates that many Americans are one unexpected expense away from financial insecurity or poverty.

Do Emergencies Even Happen?

With all this talk of emergency funds, you might be wondering how likely is one to actually occur. Well, they tend to happen more frequently than you would think. In 2017 alone, 34% of Americans experienced a financial emergency. This alone demonstrates that emergencies do happen and that everyone should take preemptive measures to prepare. Proper emergency planning would allow individuals to avoid tremendous financial setbacks if one were to occur, no matter the severity.

The Pandemic Showed the Importance of an Emergency Fund

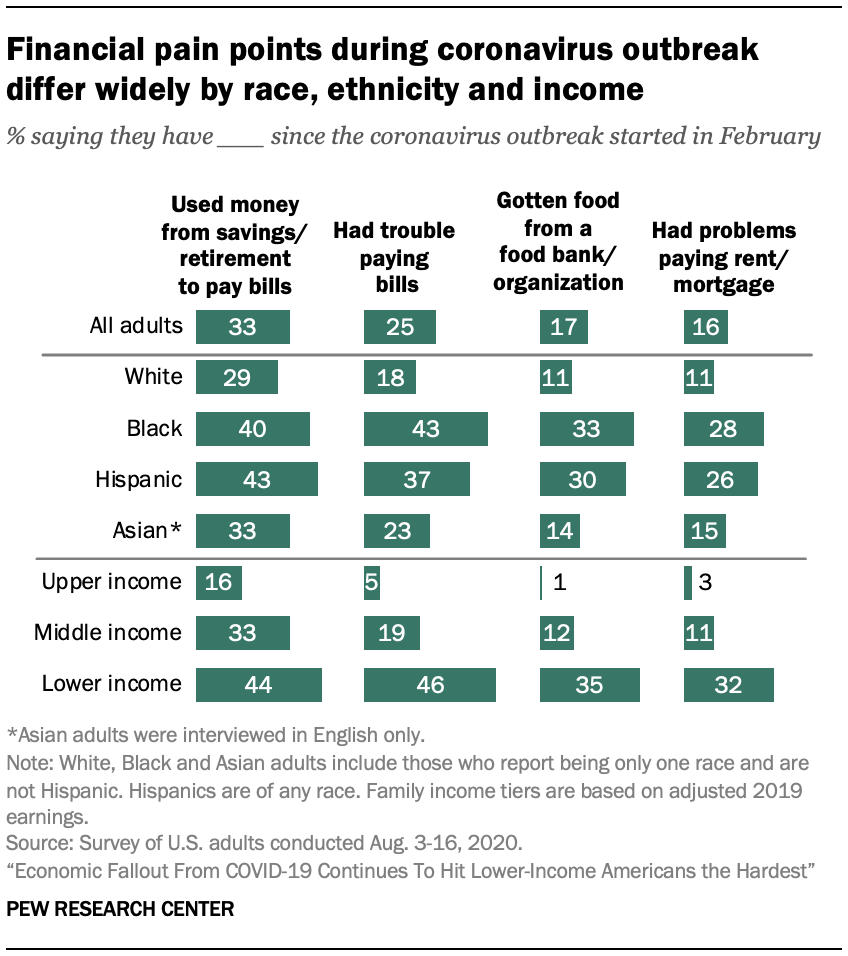

In reality, a significant amount of individuals are not properly prepared for a financial emergency. This was most evident during the COVID-19 pandemic, where many individuals across the globe faced unprecedented financial emergencies. In just a year’s time, according to the University of Minnesota, 20.6 million jobs were lost in the United States. This led to the country’s unemployment rate hitting 14.7%, the greatest since the Great Depression. As a result, many understandably had difficulties paying their expenses during the pandemic. Pew Research Center estimates that 25% of American adults had issues paying their bills due to the pandemic.

In some instances, Americans withdrew from retirement accounts and other savings to make payments. It is estimated that roughly 33% of American adults resorted to this measure, as seen in the graphic below. This is disheartening to hear, as investing correlates with greater financial security and a more comfortable retirement. Having to dip into personal savings like this is detrimental in both the present and the future.

I am, by no means, saying that people should have been prepared for a once-in-a-generation pandemic like in 2020. However, pandemic aside, people were not (and still aren’t) prepared for even the smallest of financial emergencies. If more individuals constructed emergency funds, some of the financial burdens could have been mitigated or avoided altogether.

How Much Do You Need to Save for an Emergency Fund?

The biggest question regarding an emergency fund is: how much should you save? The answers to this can vary, but the common answer is typically three-to-twelve months’ worth of expenses. Because everyone has different expenses, the amount needed for an emergency fund varies from person to person.

Because of the pandemic, many have reconsidered their recommendations for emergency savings. For example, Mark Cuban, the owner of the Dallas Mavericks and star of SharkTank, recommends individuals to use their stimulus checks to save eight-to-twelve months’ worth of expenses.

How Can I Save That Much?

Having to save that much money might seem like a daunting task. Six months’ worth of expenses is not a small amount of money. For that reason, try to avoid putting aside the entire amount all at once. Saving the entire amount at once is unrealistic and could actually be a waste of finances. Putting aside that much money at one time means that this money cannot be used for other things. As a result, you might neglect investing,‹ retirement planning, or paying debts.

Instead, try to construct your emergency fund over a longer period of time. Wells Fargo recommends individuals to put small amounts away over time until they reach their goal. I believe that this is the most realistic and feasible approach to take. It makes an overwhelming task much more attainable while allowing you to realize other financial opportunities.

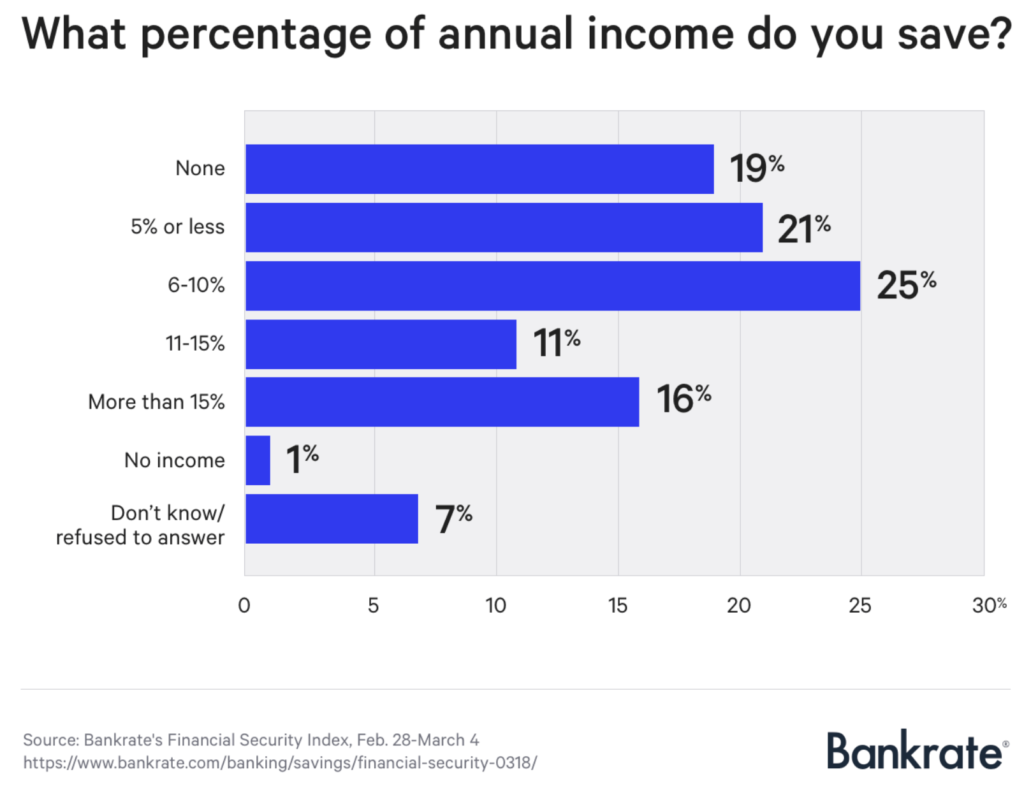

The most important aspect of this is holding yourself accountable to make contributions until you feel that you have enough in this fund. According to Bankrate, one-in-five Americans save absolutely none of their income. Please don’t be this person. Instead, you should look to save as much of your income as you reasonably can. This can be done through proper budgeting. Saving small amounts every paycheck can result in a very substantial financial safety blanket!

What If I Don’t Earn Enough to Construct an Emergency Fund?

I would make the case that many who would benefit from an emergency fund with 8-to-12 months’ worth of expenses saved cannot afford to save that much. In order to save a year’s worth of expenses, these individuals wouldn’t be able to utilize these funds in other beneficial ways, such as paying off debt and investing. Investing is one of the most effective ways for individuals to see upward social mobility and realize financial stability and independence. If those in lower socioeconomic classes focus on constructing an emergency fund with such a great amount, then it would be somewhat of a waste of resources. Instead, a more practical approach needs to be taken.

If you can afford it, then it would probably be in your best interest to save three-to-six months’ worth of expenses. This would be most applicable to those in higher income brackets. However, for those in lower income brackets, this should not apply. Instead, I would argue to save one month’s worth of expenses until you are able to realize a greater income. Economists Jorge Sabat and Emily Gallagher argue that lower-income households should only be required to save $2,467, which would equate to a month’s income.

Why Save So Little?

Well, it’s practical. For one, it’s a much more attainable goal than suggesting close to $20,000. This way, lower-income individuals are more inclined to start creating their emergency fund. Also, by just starting, they are likely to continue contributing to it later, which makes it more likely that they will have more savings. Secondly, it is statistically likely that individuals will not necessarily need more than one month of expenses covered. Thus, why commit your money to an emergency fund if you are in an undesirable financial situation to start?

Where Should You Have Your Emergency Fund?

A savings account is the best place for an emergency fund. I know I often bash savings accounts, but this is the one time that they serve a purpose. An emergency fund should never be in a checking account or a brokerage account. Having these savings in a checking account may tempt you to use them on non-emergency purchases. If you touch your savings, then you might not have enough for an emergency when it happens. Savings accounts typically do not allow you to withdraw excessively, preventing you from making an unwise decision.

Further, investing in your emergency fund is very risky. The stock market is very volatile. In a brokerage, you would not know how much you have until an emergency happens. One bad week on the market could cause your emergency savings to decrease significantly. So, utilize a savings account, where your money will not experience volatility and it’ll be safe from yourself.

Consider utilizing a high-interest savings account, so your savings fight inflation rates at a greater rate.

Bottom Line

Creating an emergency fund is a fundamental aspect of personal finance. It protects you from any unexpected financial emergency, which should be seen as a sigh of relief. Although creating one might seem daunting, saving small amounts over time makes it very attainable. Lastly, you should look to utilize a savings account for an emergency fund. Savings accounts are not volatile and prevent you from dipping into your emergency savings.

Many individuals typically recommend having around six months’ worth of expenses saved for an emergency fund. This would give you enough breathing room if an unexpected expense is thrown your way.

You can calculate the necessary amount to save for an emergency fund by calculating your monthly expenses. Once you do that, multiply that figure by six. This is roughly the amount that many experts recommend to have saved for emergencies.

Having $1,000 in an emergency fund could be enough for certain people as I outlined in the article. However, it would probably be best to save more than this. Many recommend having three months’ worth of expenses saved at a minimum.

There are some who say to save three-to-six months’ worth of expenses. I personally believe that if you can afford it, look to save for six months. You never know what life can throw your way, and it is better to always have breathing room. However, if your financial situation is not ideal, then three months should be more than enough.