In December of 2020, struggling retailer JCPenney emerged from bankruptcy after an acquisition by Simon Property Group and Brookfield Asset Management. After years of decline, the retailer is now a private company, in a last-ditch attempt to revitalize the retailer. However, with even more locations closing in 2021, it is unclear if there is a clear path to recovery.

How did the former largest retailer in the world be reduced to an afterthought? While there are obvious reasons (such as the rise of e-commerce), the fall of JCPenney is much more complex than you would think. This collapse was actually years in the making, and it serves as an excellent example of how poor management can result in complete failure.

JC…Penny Stock?

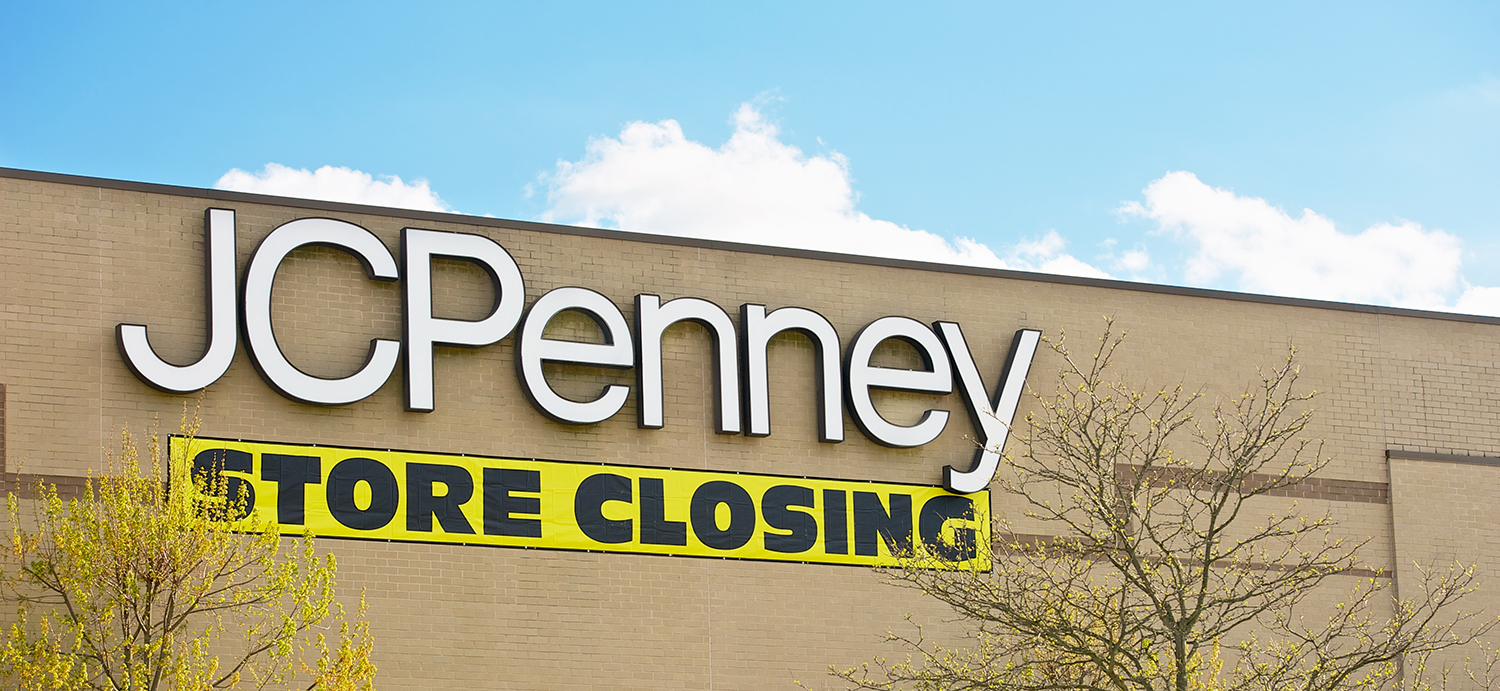

Before we discuss the reasons for JCPenney’s fall, we need to go over how dire the situation is for JCPenney. In 2020, JCPenney became the largest retailer to file for bankruptcy during the Coronavirus pandemic. The reason for its bankruptcy was the tremendous amount of debt it had on its books. As of 2020, the company had around $5 billion of debt on its books. This was an increase from 2019 when it was $3.76 billion (and reporting a net loss of $255 million). Throw in that JCP has experienced declining same-store sales, and it becomes clear that the retailer’s situation is desperate.

Its debt levels prevent the company from being able to invest in proper assets to grow and improve business. From a cash flow perspective, the company is essentially forced to sell fixed assets (such as store locations) to generate the cash flow necessary to pay down its debts.

That is exactly why the company closed

Further, the company is in jeopardy of being delisted from the New York Stock Exchange. Currently, the company’s stock is trading for about $0.32 per share. If the retailer continues to trade under the $1-mark for an extended period of time, it will be dropped from the exchange. If this were to occur, the company would be unable to issue new shares, and investors will be unable to trade shares.

In the latter half of 2019, JCPenney’s stock was trading under the $1-mark for several weeks in a row, cementing it as a penny stock. The company’s stock is down 74% over the past 12 months and down 90% over the past three years. In 2007, the stock traded for $82 per share, meaning the stock has declined 99% in the span of 12 years.

The Decline of JCPenney’s

How has the former largest retailer in the world lost 99% of its stock value since 2007? Well, there really is not one reason. The company’s downfall is due to a combination of several factors, some of which rather go under the radar.

The Pandemic Worsened the Situation

The pandemic definitely did not make the situation any better, as companies were forced to close most of their locations for months in 2020. Consequently, over 12,000 stores closed their doors for good over the last two years. This was the case for JCPenney. Management had a very interesting plan for 2020 to revitalize the company, and it did not even have the chance to put it into action. Instead, JCPenney had closed most of its locations for months, resulting in Moody’s downgrading its credit rating

I would not say that the pandemic was the reason for JCPenney’s end. Rather, it was only the final nail in its coffin. For over a decade before the pandemic, the company faced a laundry list of obstacles that it never overcame.

Retail-Apocalypse

In 2019 (before the pandemic), over 16,000 retail stores closed their doors in the United States, demonstrating the struggles within the industry. Over the past three years, a number of high-profile retailers have closed their doors, most notably being Sears and Kmart. In addition to that, many other noteworthy retailers have filed for bankruptcy protection recently. The list includes Neiman Marcus, Forever 21, and Brooks Brothers to name a few.

With so many closures and bankruptcies occurring, many like to place the blame on the rise of e-commerce. While it is definitely easy to say that Amazon is the source of all of retail’s problems, that does not tell the whole story. Amazon has without a doubt decimated many retailers, but many companies still thrive with brick and mortar locations. Just look at Vineyard Vines, which is looking to increase the number of its physical stores.

Thus, I would argue that retail is not dead. Instead, poorly executed retail is dead. This was exactly the case with JCPenney. The company has years of poor management, which played a significant factor in its demise.

Poor Management

During the 2008 Financial Crisis, JCPenney was hit harder than any of its competitors due to its large size. Despite this, the company was showing signs of growth until 2012, when its CEO Myron Ullman vacated the position. After serving from 2004 to 2011, Ullman’s departure left the retailer in search of a new leader. This search led to a very unusual candidate for the position and marked the first mistake made by the company.

An Unnecessary Rebrand

In 2012, the company named Ron Johnson as CEO. Johnson previously served as the Vice President of Retail Operations for Apple, being credited for creating the unique layout of the Apple Store. Given how successful Apple stores had become, Johnson felt it would be best to have JCPenney stores follow a similar layout. These new stores would consist of small “boutiques,” separating the different brands and styles offered by the company, and a “town square” in the center. Johnson also strayed away from JCPenney exclusive brands, in favor of more luxurious, expensive brands, like Levi’s. Further, Johnson changed the logo of the company and opted for the company to go by “JCP,” instead of a full name. Most notably, these stores would not have any discounts or deals, only having “fair and square” pricing, as termed by Johnson.

The former Apple Vice President obviously just took the Apple model and applied it to JCPenney. Unfortunately, JCPenney did not find the same success that Apple did with this model.

Johnson’s remodeling was flawed for several reasons. First of all, the layout deterred its core demographic: middle-class mothers. The stores tried to appeal to a broader, younger demographic unsuccessfully. Further, abolishing deals and discounts is a huge turnoff for a department store, especially when the industry thrives on offering better deals than competitors. Additionally, loyal JCP customers, who loved the exclusive brands, were deterred, as the company no longer offered them.

Lastly, the greatest mistake was that this layout was never tested prior to its implementation, which is astonishing. How can a company make an across-the-board transformation like this and not have a single client test done? This was doomed from the start, which led to Johnson’s dismissal in 2013.

More Bad Decision Making

The company rehired Ullman to right the ship, which he was able to do in some capacity. However, Ullman left in 2015, which led to Marvin Ellison becoming CEO. Ellison, a former executive of Home Depot, was responsible for JCPenney’s appliance sector. The bankrupt Sears was known for its appliances, and it appeared that JCPenney wanted to capitalize on its demise and steal its market share. However, it probably was not the best idea to follow the business model of a company that went bankrupt.

This idea failed for several reasons. Firstly, selling appliances has very low margins. In other words, the company would profit very little from every appliance sold. To make this sector worthwhile, the company would need to sell a high volume of appliances, which it was unable to do. Further, offering appliances did not match the brand image of JCPenney’s. The company had never been known for appliances, and existing customers never frequented its stores for these items. Thus, this was just another way that the company alienated what was once a loyal customer base.

Fun Fact: Ellison would go on to be the CEO of Lowe's, a much more fitting position given his work experience.

Is JCPenney Definitely Dead?

As crazy as it might sound, I still think JCPenny can have a future in the retail industry. Currently, the company has strong leadership in its current CEO Jill Soltau. Assuming the position in late 2018, she has done everything in her power to right the ship.

Finally Competent Leadership

In her short tenure, Soltau eliminated the short-lived appliance segment, which had incredibly low-profit margins. She also planned several new concept stores and retail labs to test how consumers react to new services. These services include a clubhouse for children, fitness classes, cooking demonstrations, coffee shops, and hair and makeup workshops. In Hurst, TX, the company revealed one of these concept stores, to the satisfaction of many customers. The new layout and appearance definitely impressed shoppers.

“We made significant progress on our efforts to return JCPenney to sustainable, profitable growth.”

Jill Soltau

JCPenney CEO

In addition to this new concept store, JCPenney, along with Macy’s, was looking to offer second-hand apparel options prior to the pandemic. The company partnered with ThredUp, the world’s largest online thrift retailer, in an attempt to attract a younger, lower-income demographic.

In 2019, the company’s stock finished the year up 9%, while finishing the fourth quarter up 55%. Soltau had been able to trim company losses in the third quarter, allowing the company has been able to shed $1 billion in debt since 2015.

Is It Too Late for JCPenney?

Unfortunately, the pandemic prevented the company from rolling out its ideas on a large scale. COVID-19 stopped all positive momentum the company built over two years, resulting in its bankruptcy in 2020.

“[JCPenney’s] finally seems to have a leader that understands retail and knows the direction the company needs to take. The question is whether it has the resource and energy to complete its journey.”

Neil Saunders

Analyst at GlobalData Retail

Despite this, I do believe that JCPenney still has a chance to execute a turnaround. Because JCPenney serves as an anchor store for most of their locations, Simon and Brookfield have a lot riding on the company. With this backing, I think Soltau could still make the right moves to make JCPenney relevant.

However, this is an uphill battle without a doubt. JCPenney still has the odds against itself, and it would take everything to go perfectly for a turnaround to occur.