Retirement planning is one of the most important aspects of personal finance, and a perfect place to start your retirement planning journey is with 401K plans. Like an IRA, a 401K plan is a retirement plan that offers tremendous tax benefits and other incentives.

One of the most notable features of this plan is that employers sponsor it. In most situations, you cannot open a 401K plan on your own. Your employer must offer it. The only exception is if you are self-employed or a freelancer. In that case, you could be eligible to open a Solo 401K plan with a brokerage. Employers are not required to offer a 401K plan to their employees, but many do. Offering a 401K plan can be a valuable tool for employers to attract and retain employees.

In addition, employers may receive tax benefits for making contributions to the plan. In this case, employees will essentially receive ‘free money’ from their employer to go towards their retirement plan. This can supercharge your retirement savings, making 401K plans extremely powerful.

Why You Need to Know About 401K Plans

Retirement planning is completely different than before. Our parents and grandparents might have had the luxury of relying on pension plans and Social Security benefits in retirement. Today, however, we can’t really rely on either.

Your employer likely doesn’t offer a pension, unless you are a public employee. As of 2019, there was a 53% decline in defined benefit plans (pensions) by private employers since 1975. Over that same time span, defined contribution plans (401Ks) have increased by over 200%. Since 401Ks are self-directed, retirement planning now requires you to do all the work, not your employer.

Additionally, with every year that goes by, Social Security becomes less and less secure. In 2037, the United States expects Social Security benefits to be completely exhausted. This uncertainty doesn’t make it reliable to factor into your retirement planning.

These plans are offered by more and more employers. As you’ll see, they are very powerful for retirement planning. Additionally, you really don’t have alternatives anymore, as both Pension Plans and Social Security are on the way out. Read my article on the changing dynamics of retirement planning to learn more.

Without learning how to plan for retirement yourself, you run the risk of not being able to retire. With our school system failing to teach us financial literacy, this needs to be something you learn on your own. Thankfully, this article is here to outline everything you need to know about 401Ks, a great tool for planning retirement.

Contribution & Income Limits:

In 2023, the 401K contribution limit for those under 50 is $22,500. If you are over 50, you have the option to contribute an additional $7,500, making your total limit $30,000 (IRS). For 2022, the contribution limit is $20,500, with a $6,500 catch-up provision for those who are 50 or older. These limits also apply to 403(b) and several 457 plans, which we’ll touch on later (IRS).

Additionally, there are no income limits for 401K contributions, meaning you can contribute to these plans regardless of your income. However, there are income limits regarding employer-matching contributions. For 2023, an employer can only match up to $330,000 of your salary, an increase from $305,000 in 2022. This limit is adjusted every year based on inflation (IRS).

Withdrawal Requirements:

With 401K plans, you can’t make withdrawals until you are 59½ or until after a 5-year holding period. In other words, all contributions in a Roth 401K have to remain in that account for 5 years and until you are 59½ before you can use them (Bankrate). The 5-year holding period is very applicable to those utilizing catch-up provisions in the later stages of retirement planning. Any withdrawals made prematurely will result in a 10% penalty and the applicable income tax.

Required Minimum Distributions (RMDs)

For all 401K plan types, you must begin making withdrawals starting April 1st of the year after you turn 72 (Kiplinger). This is a requirement made by the US government. These RMDs are taxed as ordinary income, which can increase your total taxable income for the year. This is very important to note, as this could put you in a higher tax bracket for the year. If this happens, you may have to pay more taxes on your Social Security income and/or pay more for Medicare expenses. So, it is important to take this into consideration as part of your retirement planning. For more in-depth planning, consider discussing more with a tax professional.

To calculate your RMD, you take your balance at year-end and divide it by the IRS life-expectancy factor (Kiplinger). For 401Ks, you are required to calculate and withdraw RMDs for each account separately. For IRAs, on the other hand, you would calculate the RMD for each account, but you can make a withdrawal from a single account to cover the total RMD balance. RMDs can be taken in installments or in a single lump sum. It totally depends on your preference and lifestyle needs in retirement.

RMD Penalty

If you fail to make your RMD, you will be penalized. The difference between what you withdrew and what you should’ve withdrawn is taxed at 50% (you read that right). For example, if you have an RMD of $15,000, but only withdrew $5,000, you would be penalized $5,000 (50% of the $10,000 difference). In addition to this, you would also owe the normal income tax on this amount (Kiplinger).

You could ask the IRS for penalty forgiveness by filing Form 5329, with an explanation. However, it is probably best to try to avoid missing RMD deadlines. The best way to do this would be to ask your account custodian to make these withdrawals on your behalf (Kiplinger).

Employer Matches

Many employers offer matching contributions for their employees’ 401K plans. Matching contributions are typically a percentage of the employee’s contribution, up to a certain limit. As noted earlier, there is also an income limit for how much an employer can match. As of 2023, that threshold is $330,000.

Here’s an example: let’s assume that a company has a matching program, where if an employer contributes 6% of their check, the company will pay an additional 3%. If an employee, who makes $100,000, contributes 6% of their salary ($6,000), then the employer would contribute an additional 3% ($3,000) on their behalf. In other words, having an employer match is free money towards your retirement, making it extremely powerful for your retirement planning.

Some employers can also make non-elective contributions, which are made regardless of whether the employee makes a contribution. This can also be very helpful for your retirement, as you are not required to put any of your own money into your retirement. In this case, your employer is funding your retirement for you.

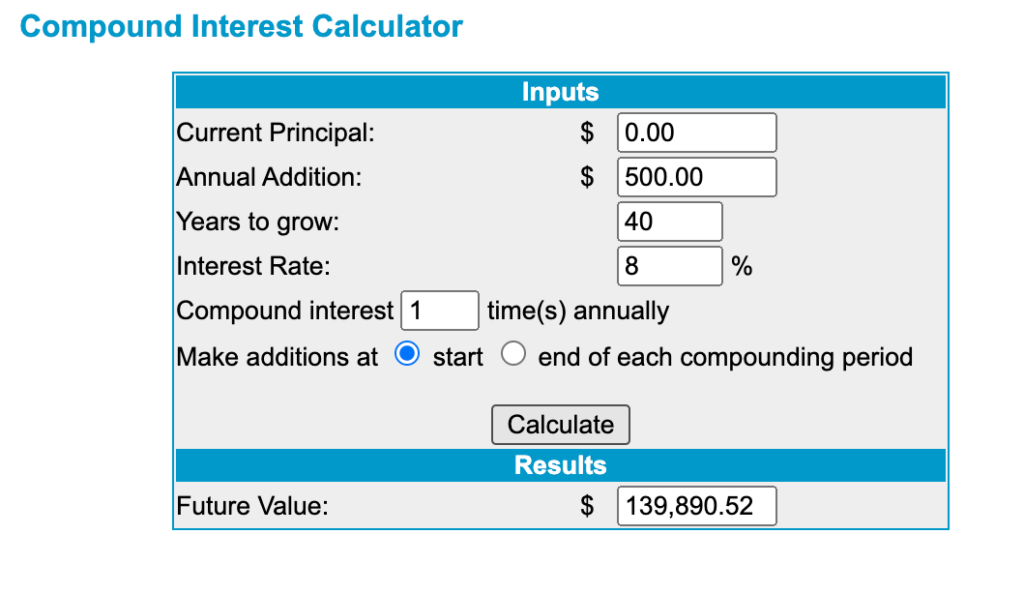

In my opinion, an employer match is the most powerful tool that you could use for retirement planning. Especially when you are young and don’t have high income, getting an additional boost in your savings can make a world of difference later in life. With compound interest, employer matching contributions early in your career can potentially fund significant parts of your retirement.

Limitations

Unlike IRAs, with 401Ks, you do not have complete discretion over your investments. While you do have complete say over how your funds are allocated across investments, you do not have say in what investments are available to you. Your employer chooses the investment options within its 401K plan.

Some employers may offer plans that have limited investment options, possibly only a few ETFs and company stock. Others may have plans with a number of possibilities for you to choose from. Not all 401K plans are equal, and it is ultimately up to your employer to provide a good 401K plan to its employees.

Tax Benefits

In addition to employer matches, 401K plans also offer tremendous tax benefits. Much like IRAs, the tax advantages of a 401K depend on the account type (Roth or traditional).

Traditional 401K Plans

A traditional 401K plan allows you to make pre-tax contributions, which would lower your taxable income on the year through deductions. While contributions are tax-deductible, all withdrawals from this type of IRA are taxable in retirement. With traditional IRAs, you are unable to make withdrawals until you are 59½.

In regards to tax planning, it is preferable to use a traditional IRA if you’re currently in a high tax bracket and expect to be in a lower tax bracket in retirement. Contributing to your traditional IRA would lower your taxable income in the current tax year, which would result in savings. Additionally, in retirement, if you are in a lower tax bracket, those withdrawals would be taxed at a lower tax bracket than they would be at your current tax bracket. This means you realize tax savings across the board.

Please consult a trusted tax professional for more regarding your retirement tax planning.

Roth 401K Plans

A Roth 401K Plan is funded with after-tax dollars. In other words, all contributions are not tax-deductible. However, qualified withdrawals in retirement are tax-free (yes, you read that correctly). This means that all income/gains realized in these accounts are not subject to tax.

Something worth noting is that, unlike Roth IRAs, Roth 401K plans do have required minimum distributions starting in the year you turn 72 (which increased from 70½ in 2019).

In regards to tax planning, Roth 401Ks are preferable if you are currently in a low tax bracket and expect to be in a higher tax bracket later in retirement. This situation likely describes most young people. In this case, you would be paying taxes on your income, then make a contribution to your account. Since you are in a low tax bracket, the tax you pay will likely be a lot less than it would if you were to choose the traditional. Then, in retirement, you get to pull from your retirement accounts without having to worry about taxes.

Please consult a trusted tax professional for more regarding your retirement tax planning.

Do You Have to Choose Between These Account Types?

Like IRAs, you do not have to pick one of these two account types. You are able to contribute to both a Roth 401K and a Traditional 401K within the same year. However, the contribution limit applies to total contributions, not to each individual account. In other words, for 2023, you are only able to contribute $22,500 between a Roth and a traditional 401K. You can’t contribute $22,500 to each account.

How you choose to allocate contributions between these accounts depends on your tax situation. As noted earlier, Roth and traditional accounts have specific situations regarding whether they are more beneficial. Consulting a tax professional or financial planner may help you figure out what makes most sense for you.

How Do I Open a 401k?

Unfortunately for most people, you cannot open a 401K account unless your employer offers it. If they do, they will be able to walk you through their process. Most likely, they will use a brokerage, such as Fidelity, Charles Schwab, or Merrill.

If you do not work for an employer that offers a 401K option, then you will be unable to open an account. If you are a public sector, not-for-profit, or government employee, you may be able to invest in a 403b or 457 plan. Both plans are like the 401K and offer similar benefits.

If these options are also unavailable, you would have to look elsewhere for retirement planning. In this case, you could really take advantage of your IRA, since you can open it on your own.

In certain circumstances, you can open your own 401K. If you are self-employed, you could take the necessary steps to create your own 401K.

What Happens When You Leave Your Employer?

Since your employer sponsors your 401K plan, the plan will stay with that employer when you leave unless you do something about it. When leaving an employer, you have a few options for your 401K (Investopedia).

Liquidate the Account

You could withdraw all funds within the 401K plan once you leave. However, if you do this, you are liable for an early withdrawal penalty in addition to income taxes on all gains. For Roth accounts, you can always withdraw contributions since they are post-tax dollars. This might not be a wise move, since you are tapping into retirement savings in the middle of your career (Investopedia).

Rollover the 401K into an IRA

With this option, you would be able to transfer all the funds in your 401K into an individual retirement account. This would allow you to have access to unlimited investment options and maintain the same tax treatment. You may want to consider discussing this with a tax professional, as the IRS does have various rules in place over this. The custodians involved in this transfer may also be able to guide you through the process (Investopedia).

Leave the 401K at Your Old Employer

Some employers may allow an existing employee to keep their 401K funds within their plan. This makes sense if you like the investment options and how the plan is managed. However, if you do this, you are no longer able to contribute to this account. Additionally, you may forget that this account even exists, since it is with an older employer. If this were to happen, you’d be throwing away thousands in retirement savings (Investopedia).

Move the 401K to Your New Employer

Instead of leaving it at your old employer, you could roll over the funds into your new employer’s plan. This is similar to an IRA rollover. If you are someone who is uncomfortable making their own investment decisions, this may make more sense (Investopedia).

Early Withdrawal Penalties & Exceptions:

In most instances, a withdrawal from a 401K prior to 59½ results in the amount being taxed at your income tax rate plus an additional 10% penalty (IRS). This rule is to encourage people to use these funds only for retirement.

However, this is not the case for contributions to Roth 401Ks. Since they are after-tax funds, all contributions can be withdrawn without tax or penalty (Bankrate). However, you would still have to pay tax on any earnings withdrawn from the account. For example, if you contributed $100 and made an additional $50 in your 401K, you would be able to withdraw the $100 without penalty but not the $50.

Rule of 55

If you leave your employer in the year you turn 55 or after, you are able to withdraw from that employer’s 401K (or 403(b)) plan without penalty. If you are a public safety worker, you may be able to do so in the year you turn 50. While it is penalty-free, you still have to pay the income tax associated with the withdrawal.

It doesn’t matter why you left your employer either, whether it’s retirement, layoff, quitting, or firing. This doesn’t mean you have to stop working, however. You are able to return to work once leaving this employer.

It’s worth noting that not all employers allow for this early withdrawal and, if they do, they might require the withdrawal to be in a single lump sum. If this is the case, then it could have serious tax consequences. Additionally, this rule only applies to plans of your most recent employer. The IRS does not allow this exception for plans with earlier employers. To use Rule of 55 with those funds, you would need to roll over those accounts into the plan provided by your most recent employer.

This can be very beneficial to those looking to retire early. Social Security benefits are not available to you until you turn 62. So, this can allow you to get a headstart on your retirement without having to pay a penalty (SmartAsset). However, it’s important to keep in mind that these funds should last for the entirety of your retirement. Prematurely touching your retirement funds can be risky.

Substantially Equal Periodic Payments (SEPP) or Rule 72(t)

Under code 72(t), section 2, individuals can make early withdrawals without penalty if they meet certain SEPP requirements. The requirements include having to take at least five ‘SEPPs’ based on a calculation using your life expectancy through one of the IRS-approved methods. You can read more on these methods in this Investopedia article. Also, the withdrawals must follow a specific schedule for 5 years or until you turn 59½, whichever is later.

While this could help those looking to retire early, it also can be dangerous to withdraw from a retirement account at an early age. Investopedia sees this method as a ‘financial last resort,’ as the IRS does allow for other exceptions in case of specific emergencies. Whenever you consider making an early withdrawal, consider how it can impact your retirement.

Hardship Withdrawals

If your employer allows it, you can make an early withdrawal for “an immediate and heavy financial need” without penalty (Bankrate). Hardships include unreimbursed medical expenses, payments necessary to prevent eviction/foreclosure on a principal residence, funeral or burial expenses, purchase of a principal residence, to pay for certain expenses for the repair of damage to a principal residence, and payment of college tuition and related educational costs. While this may sound like a positive, it definitely has drawbacks.

If you decide to do this, the IRS wouldn’t allow you to replace or return these funds back to your account. In other words, once you withdraw these funds, they are permanently removed from the account. You would need to make normal contributions to replenish what you withdrew.

Additionally, your employer may freeze your contributions for several months after this withdrawal. So, doing this could definitely be a setback for your retirement planning. You should only look at hardship withdrawals in cases of extreme financial hardship. Otherwise, you should look to other means, like an emergency fund.

401K Loans

In this scenario, you’re loaning yourself money from your 401K plan. The requirements of the loan may depend on your employer. Some employers may not even offer this as an option. Your employer would lay out whether they offer this in addition to the maximum and minimum amounts and any rules that you need to follow.

Typically, employers allow you to take out as much as 50% of your vested account balance up to $50,000 in a year. It’s also common for employers to allow only one loan at a time and to require consent from a spouse/partner prior to opening one. Additionally, for these loans, you’re required to pay back the principal and interest within 5 years. In other words, you are paying yourself back with interest.

401K Loans vs. Hardship Withdrawals

Fidelity makes an argument that a 401K loan can be the preferable option compared to a hardship withdrawal. Let’s take a look at the following example:

Taking a loan: A 401K participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account.

Taking a withdrawal: If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out a total of $23,810 to cover taxes and penalties, leaving only $14,190 in their account.

When taking out a hardship withdrawal, you still owe taxes. So, you would need to take out additional funds from your account to cover the tax expense. With the loan route, however, you do not owe taxes since it is a form of debt that you pay back. This means you’d be able to keep more funds within your 401K.

While a 401K loan might sound interesting, it definitely has its drawbacks. For one, the interest you pay yourself will likely not be greater than the return you’d realize leaving the money in your account. For example, if you pay 3% interest towards your account, that would be lower than the average S&P 500 return of 8% (Official Data Foundation). You are able to make contributions to your 401K with a 401K loan outstanding (Forbes). But, having to pay principal and interest payments may take away from those contributions. This would be harming your retirement savings in an indirect way.

Further, since it is a loan, you do run the risk of defaulting on it. If you are unable to make payments on a 401K loan, it’s basically treated as an early withdrawal. In that case, you would be subject to applicable income taxes and that 10% penalty. Also, if you leave your employer that sponsored the plan without paying off the loan, you’d have a small time window to pay off the loan. So, ‘defaulting’ on the loan is something that can happen.

Other Exceptions:

IRS Levies: If you are required to pay previously unpaid federal taxes, the IRS can withdraw from your IRA penalty-free. In this case, the IRS must be the one making the withdrawal to avoid penalties.

Medical Debts: If you are in debt for medical expenses that are greater than a specific percent of your adjusted gross income, you are able to make a penalty withdrawal in the same year as the expense.

Permanent Disability: If you are permanently disabled and physically unable to work, you can make tax-free withdrawals. These withdrawals can be used for any purpose. However, you may need to show evidence of the disability.

Divorce Settlements: You may make penalty-free withdrawals if it is for payment as part of a divorce settlement/agreement.

Active Military Deployment: If you are a reserve in the military and are called into active duty for at least 179 days, you may make ‘qualified reservist distributions’ without penalty.

Birth or adoption of a child: You are able to withdraw $5,000 within the first year of a child’s birth/adoption without penalty.

Are 401K Plans Scams?

Recently, I’ve seen many people on Twitter, TikTok, and other social media saying that a 401K is a scam. In my opinion, that can’t be any more wrong.

Do 401Ks have drawbacks? Of course. There are limited investment options, contribution limits, potential fees, and an age limit of when you can start making withdrawals. However, these claims are misguided and incorrect.

401Ks are Regulated

Firstly, 401K plans are regulated by the US government to protect employees. The Employee Retirement Income Security Act (ERISA) and the Internal Revenue Service (IRS) oversee 401K plans to ensure that the fees charged are reasonable and that the plan’s investments are managed in the best interests of the participants.

401K Plans = Convenient Retirement Planning

Additionally, 401K plans aren’t scams because they offer a convenient way for employees to save for retirement. Once set up, your employer automatically deducts the contributions from your paychecks. This can make the retirement planning process simple, as it takes out steps that are required for IRAs and other retirement vehicles.

The Matches are Great

Further, 401K plans often offer a matching contribution from the employer, which can significantly increase the amount of savings an employee has in retirement. Receiving these matches is ultimately getting free money for your retirement. How can free money be a scam?

Not All 401K Plans are Limited

And, while 401Ks can be limited in terms of investment options, some 401K plans can offer great flexibility. No two plans are the same. Some can offer a wide variety of options, including stock funds, bond funds, REITs, etc., while others don’t. So, to paint all 401K plans as scams, for this reason, is rather misguided.

You can also argue that having limit options is a positive. Having unlimited options can be overwhelming for those just starting out. For example, with an IRA, you are able to invest in practically anything (stocks, bonds, real estate, even crypto). But, investing in these different things without understanding what thought should go into it can be dangerous. So, in a way, having only a few reputable mutual or index funds available as options can serve as training wheels. This ensures you don’t do anything too risky, like spending all of your retirement savings on an NFT.

The Minimum Withdrawal Age Is There for a Reason

Lastly, the biggest criticism of 401Ks (and other retirement plans) is that the age of withdrawals (59½) is too old. Many may think: “I don’t want to retire so late. Why should I be living my life to the fullest at such an old age?” While I understand the idea behind this, I also think this isn’t correct. The reason for this age requirement is to ensure younger adults do not waste their retirement savings. Having this requirement and an early withdrawal penalty makes it so you keep the money in your account until you retire. Nothing is worse than having your retirement in jeopardy due to a lack of planning.

And, as mentioned earlier, there are numerous exceptions that allow you to make early 401K withdrawals without penalty. So, even if you had a reason to touch your savings, you could with no penalty.

The Minimum Withdrawal Age Isn’t Even That Old

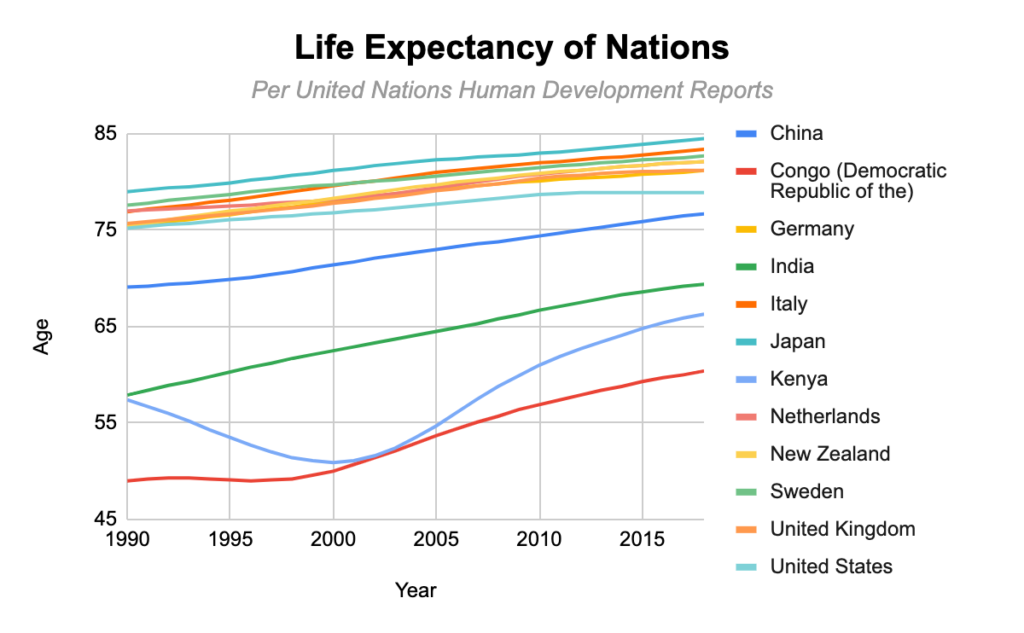

Additionally, 59½ is not all that old. According to the CDC, the average lifespan in the US is 76.4 years old. That means, if you retire at 60, you will have over 15 years of retirement as of today. As technology advances, I’d expect this life expectancy to increase, meaning retirements will only become longer. This means your quality of life at an older age will likely not decline as dramatically as it does today.

Again, I do understand the argument. Working for 40 straight years of your life might seem a little overboard. But, choosing not to use a 401K because it’s a ‘scam’ doesn’t offer a solution. To ensure a safe retirement, there is no better retirement vehicle than a 401K. It offers you preferential tax benefits and potential employer matches. While working for four decades might seem like a lot, what if you had to work even longer because you never took retirement planning seriously? There is no better (or more tax-efficient) alternative for your future than a 401K.

Bottom Line on 401K Plans

Overall, 401K plans are probably the most powerful retirement tools available to you. The greatest benefit of a 401K is an employer matching program. Receiving a match is an automatic return on your investment. If your employer currently offers a match for your 401k contributions, you should consider taking full advantage of that before anything else. An employer match is free money towards your retirement.

Additionally, with these accounts, you can receive preferred tax treatment (either having tax-free growth or current-year tax deductions). So, not only can you receive free money for retirement, but you can also choose the tax treatment of that money’s growth.