Even as young children, we have been told how important it is to plan for retirement. However, this idea is never explained in detail. Instead, we usually heard this in passing rather vaguely. The root of this very well might be due to how retirement planning used to be. Some of our parents and grandparents had the benefit of having their retirements planned for them. In other words, retirement planning for them was very passive.

For decades, Americans would work the same job for 40 years, all while their employer contributed to their pension plans. This was in addition to benefitting from Social Security. Between both of these plans, these individuals would be able to enjoy a comfortable retirement planned by both their employer and the government. Funny enough, not planning at all used to be a very feasible approach to retirement planning. However, modern financial markets have changed, and this method of preparing for retirement is no longer a reality. Today, things are completely different. Meaning, you need to plan for retirement like never before.

There Are Just Too Many People Living

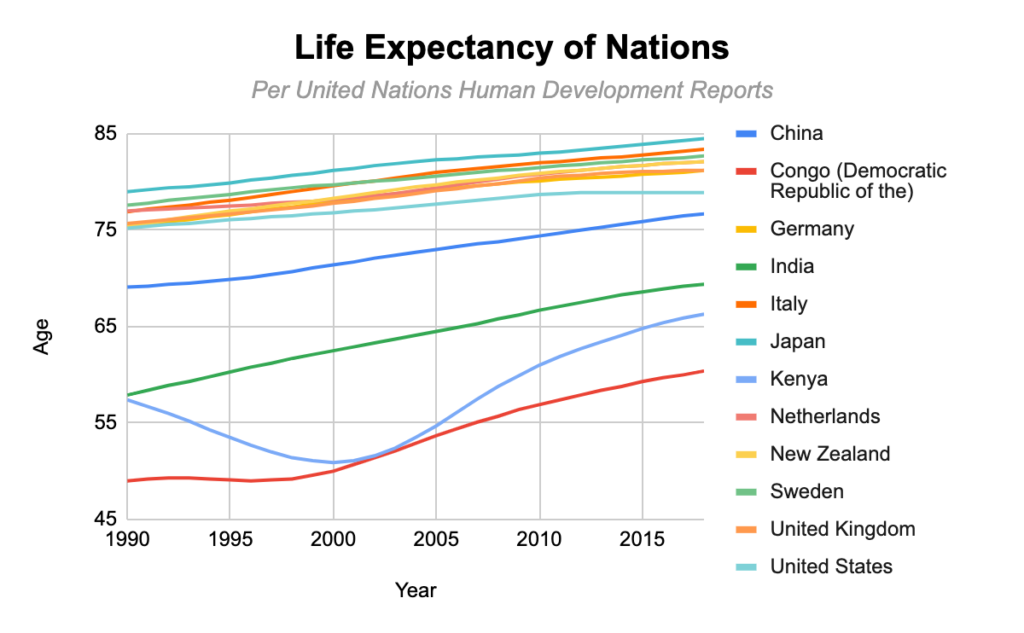

Okay, that title might sound a little strange, but hear me out. As countries become more developed, the life expectancies of their citizens rise. With increased life expectancies, countries begin to see larger populations. In turn, there are more individuals than ever looking to rely on employer-sponsored pension plans and government-sponsored Social Security programs.

Pension and Social Security plans were sustainable for years because many individuals were not living long enough to completely take advantage of the benefits. However, today, countries are seeing populations way too large to support such programs. As seen in the graph above, life expectancies of developed nations are the highest they’ve been in 30 years. Ultimately, there are simply too many people relying on these programs for them to be feasible for employers and governments to offer. Consequently, both have fallen out of favor in society, as they are becoming less and less reliable for retirement planning.

Pension Plans are on the Decline

As of 2019, there was a 53% decline in defined benefit plans by private employers since 1975. Over that same time span, defined contribution plans have increased by over 200%. What does this mean? Defined benefit plans are primarily funded by employers. These plans provide employees with guaranteed retirement benefits for life once in retirement. On the other hand, defined contribution plans are funded primarily by employees. So, this statistic shows that employers are reallocating the responsibility of retirement planning from themselves to individual employees. In other words, today, employees cannot rely on their employers to plan for their retirements. Instead, they must take on the responsibility themselves.

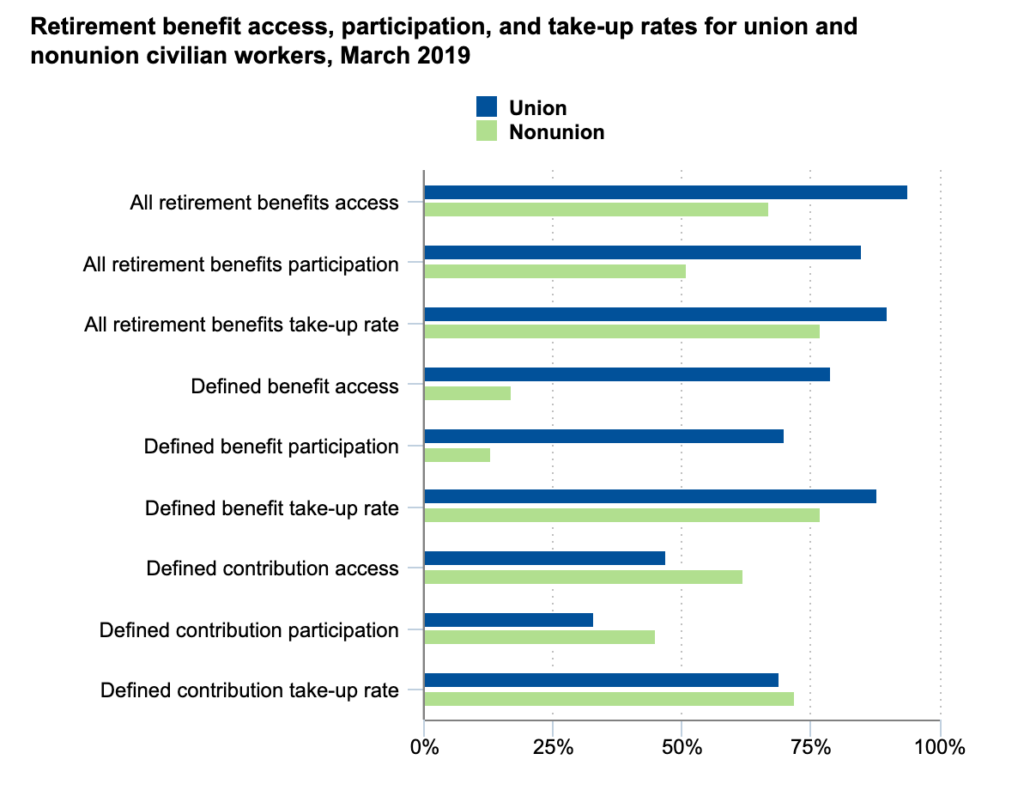

This is Particularly True for Non-Union Employees

While pensions are on the decline as a whole, this is especially the case for employees not belonging to a union. As shown below, of union workers, 94% have access to employer-sponsored retirement benefits, and 79% have access to a defined benefit plan. On the other hand, for non-union workers, only 67% have access to retirement benefits offered by an employer, and only 17% have access to a defined benefit plan. Union workers are significantly more likely to have access to an employer-sponsored defined benefit plan, which puts non-union workers at a disadvantage.

It is also worth noting that unions are common in public sector professions (such as police officers, firefighters, teachers, etc.). They are not as common in the private sector, which suggests private-sector employees may also be at a disadvantage. Having a strong union’s protection proves to be very beneficial to employees. As demonstrated in this case, unions fight for employees’ retirement benefits, ensuring that they would be able to see a safe retirement when the time comes.

Harmful Effects of Declining Defined-Benefit Plans

With this change in the dynamic of retirement plans, many older-aged Americans, specifically those labeled as “boomers,” would be harmed. This change from defined benefit plans to defined contribution plans would result in family incomes for boomers to decline, especially for younger ones.

With more pensions being frozen, younger ‘boomers’ would suffer greatly. These individuals would not have enough job tenure to reap the full benefits of their defined benefit plans. Further, after these freezes, they also may not have significant time to contribute to a defined-contribution plan to fully benefit from it. That’s if they actually take the measures to plan for their own retirement. Thus, they would be caught in retirement planning limbo, with no real favorable outcome.

The numbers unfortunately support this. For those born between 1961 and 1965, it is projected that 26% would experience a lower family income as a result of this shift in retirement planning, with 5% realizing at least a 5% decline. This far outweighs the benefits this phenomenon provides, as only 11% of these individuals would realize an increase in family income as a result.

We Can’t Rely on Social Security Benefits Either

In addition to a private pension plan, many employees used to look forward to benefiting from Social Security benefits in their retirement. While retirees now can still look to utilize Social Security benefits, it cannot be done to the extent that older generations would. There was a time when individuals could solely rely on Social Security to fund their entire retirement. Unfortunately, those days are no longer here.

These benefits are less secure than ever before, and the American government believes the same. In 2037, the United States expects Social Security benefits to be completely exhausted. This uncertainty doesn’t make it reliable to factor into your retirement planning.

Further, even if you do receive Social Security benefits, it is likely not enough to completely replace your pre-retirement income. If anything, it will probably be only a small percentage of it. To get an estimate yourself, you can use this Social Security Calculator.

Retirement Planning is Now YOUR Responsibility

With pension plans falling out of favor with employers and the future of Social Security uncertain, individual employees can no longer rely on automated means of retirement planning. Thus, they must plan for their own retirement through the use of 401ks and individual retirement accounts (IRAs).

These retirement investment plans place all the responsibility of investment decisions on the individual. This contrasts with defined contribution plans and social security, which rely on larger institutions that have tremendous knowledge of financial markets and concepts. Smaller investors are now required to be observant of their investments over their lifespans. However, a significant number of individuals globally do not comprehend financial principles. As a result, financially illiterate individuals are at risk of not being able to retire comfortably, if at all.

Many Americans Have Not Adapted

While financial markets have changed, the behavior of individuals sadly has not. American workers have not adapted to these changes in the market, as many are not preparing for their retirements. They are behaving as if they can rely on pension plans and Social Security benefits. If these individuals possessed greater financial sophistication, they would understand that this is not the case. Because financial institutions no longer help workers, they can no longer be idle in preparing for retirement. The responsibility of investing is placed on the individual employee.

Without a proper understanding of how financial markets work, these individuals will not be able to properly plan for their retirement. Those who are financially literate are much more likely to experience a secure retirement. Further, studies have shown that those who prepare for retirement generate three times as much in doing so than those who do not prepare for retirement. If these individuals do not attain a proper grasp of financial literacy, they are likely to make poor decisions that would affect both their short- and long-term financial situations, such as their ability to retire.

Why You Should Plan for Retirement Now

Without the help of larger institutions, individuals are becoming only more and more responsible for planning their own retirements. This means that the way society views planning for retirement has to change. If individuals knew of the importance of retirement planning and investing, I’m positive more people would take initiative. Like with investing, there are many benefits that come from planning for retirement as soon as possible. Here are just a few:

Younger Dollars are More Powerful

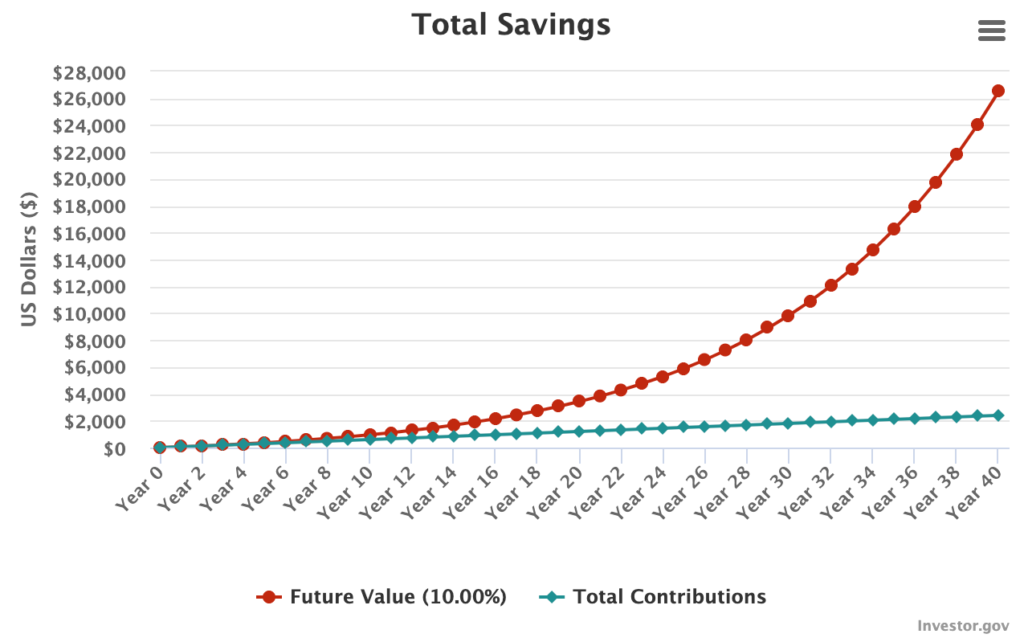

While young, people need to take advantage of their youth and invest as early as possible. Doing so would give these individuals a greater chance of securing a safe and comfortable retirement. Younger individuals could save rather small amounts of money and still have a sufficient amount of funds for their later stages of life.

If a twenty-year-old were to invest $5 monthly over the course of forty years with a 10% return, they would have a portfolio worth over $26,000 by the time they retire. Of that $26,000, the individual only contributed $2,400, meaning over 90% of the portfolio is a result of compound interest.

Avoiding Taxes!

Yes, you read that correctly. One of the most notable benefits of retirement planning is in regard to taxes. Various retirement plans provide tax incentives for individuals. An example of a retirement plan with a very beneficial tax incentive would be the Roth IRA. A Roth IRA is probably one of the best investment vehicles for retirement planning. With this plan, all contributions made to the account are post-tax. Because of this, all gains realized within the Roth IRA are actually tax-free. Not having to pay taxes on realized gains, in this instance, means the investor can accumulate significantly larger amounts of wealth to enjoy in retirement.

There are Roth 401Ks, which offer the same tax benefits. In addition to that, they have much higher contribution limits than IRAs, which means you can realize even greater tax-free gains. Regardless of which you select, utilizing either Roth plan would provide retirees with tremendous tax benefits.

Get Free Money!

Again: Yes, you read that correctly. Another benefit of retirement planning comes with using a 401(k) plan. This is another retirement plan that, unlike an IRA, has to be offered by an employer. Otherwise, an individual cannot open one (Internal Revenue Service). With these plans, the employer has the option to match a portion of the contributions made to the 401(k). For example, a company could have a matching program, where if an employee contributes 6% of their salary, the company will match half of their contributions. If an employee making $100,000 contributes 6%, or $6,000, of their salary to the 401(k), then the employer would contribute an additional $3,000 to their 401(k) account. Ultimately, if an employer offers a matching program like this, the employee would essentially be paid for making contributions towards their retirement.

Possibly Retire Early!

By being responsible for your own retirement, you have complete say over when you choose to retire. So, who’s stopping you from being very aggressive and retiring early?

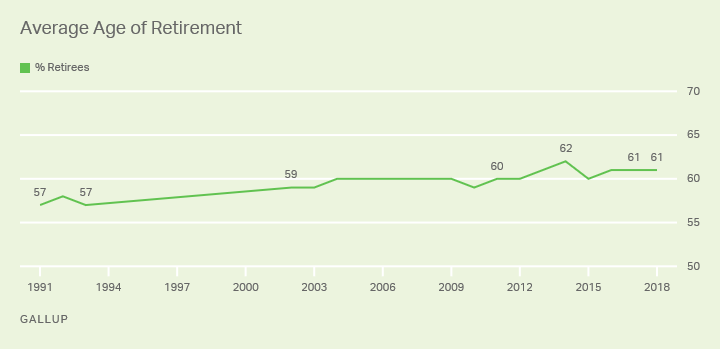

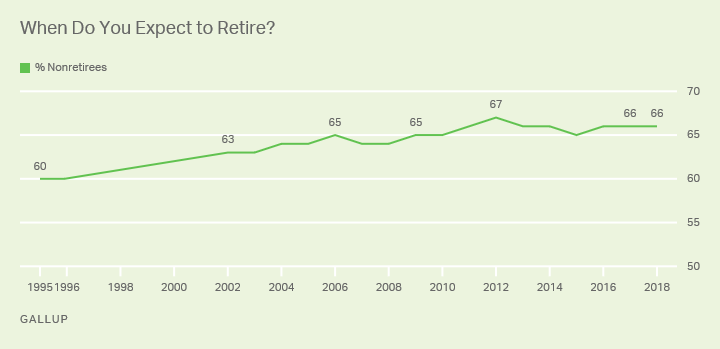

The benefits are amplified the earlier an individual starts, as compound interest has a greater impact with greater amounts of time. Early retirement planning could result in an individual experiencing an earlier retirement, which could be very beneficial. In the United States, the average age of retirement is sixty-one years old, with many non-retirees anticipating a retirement age of sixty-six, as demonstrated in the charts below. This is while the average age of death in the country is about seventy-nine years old. With this information, it can be concluded that the average length of retirement in the United States is roughly eighteen years, with it likely shortening in the near future.

So, after decades of working, many Americans will only be able to experience financial freedom for less than twenty years. There is also no certainty that retirees in this stage of their lives will be free from illness or not experience increased immobility. If either were to occur, these individuals would not be able to truly enjoy their retirement. In this scenario, they would have given the best years of their life to their career and experienced their retirement with a poorer quality of life. This can be avoided with proper retirement planning at an early age.

Between tax incentives and potentially matching contributions, retirement planning can definitely provide various benefits.

As demonstrated in earlier examples, investing at an earlier age can compound returns and allow small contributions to have a tremendous impact. Thus, if younger individuals took their retirement planning more seriously, they could save throughout the early stages of their lives and potentially retire at an earlier age than what is deemed normal. This would prevent many from experiencing financial insecurity at an older age and potentially allow them to realize upward social mobility ultimately.

Bottom Line – Plan for Retirement Now!

Retirement planning is not like it used to be. Employers and the government no longer plan for employees’ retirement. Instead, the responsibility of retirement planning is solely on the employee. Accordingly, employees need to take initiative with their planning, especially at a young age. If they do not, they are at risk of not being able to retire comfortably, if at all. Additionally, there a many benefits to being hands-on in your retirement planning process. As outlined earlier, doing so could lead to tax benefits, employer matches, the power of compound interest, and potential early retirement. So, don’t put off saving for retirement any longer; start planning for it today!

For more resources on retirement planning and investing, check out the rest of Common Cents Finance!