An IRA, or Individual Retirement Account, is a type of investment account specifically designed to help individuals save for their retirement. An IRA itself is not an investment. Like a checking or savings account, it is simply an account to invest in. In other words, just putting money into this account doesn’t mean you are investing.

With these accounts, there is an emphasis on the word ‘Individual,’ as all investments are directed by you. You have a complete say in how to invest your money in an IRA. In your account, you can choose whatever you want to invest in, including stocks, bonds, mutual funds, ETFs, and even real estate. Being self-directed is one of IRA’s greatest strengths. Having endless investment options is not the case for all retirement accounts, which we’ll see shortly.

In addition to this freedom of choice, IRAs also provide tremendous tax benefits. The benefits differ depending on the account you choose. There are two main types of IRAs: traditional and Roth.

The purpose of this article is to provide readers with a comprehensive guide to IRAs. We will cover everything from how much money you need to open an account to the best providers for IRA accounts. We will also compare the benefits and drawbacks of IRAs, discuss investment strategies for maximizing returns, and explore common questions about IRAs.

Why You Need to Know About IRAs

There are three main reasons why you should know about IRAs:

Early Retirement Planning Results in Great Amounts of Wealth

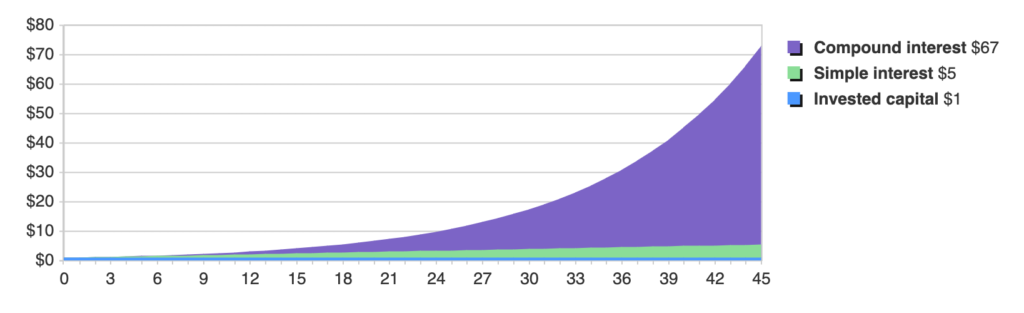

The earlier you start planning retirement, the better. If you started your planning at age 20, for example, every $1 you invest would grow into $73 by the time you retire. In other words, money invested at 20 years old would grow 73 in size by retirement. To me, that makes retirement planning a no-brainer. Where else would you be able to grow your money 73 times in value?

You Can Advantage of Tax Benefits

IRAs provide tremendous tax benefits. Depending on the account (which we’ll touch on later), you can receive tax deductions or tax-free growth on investments. In other words, you can save on paying Uncle Sam. Who wouldn’t want to ditch some taxes?

No One is Planning Your Retirement for You

This might sound redundant, but retirement planning makes sure that you can retire. Otherwise, you might run the risk of not being able to retire whatsoever.

At one point in time, it was completely possible for you not to plan for retirement and be okay. Our parents and grandparents might have had the luxury of relying on pension plans and Social Security benefits in retirement. Today, however, we can’t really rely on either.

Pension plans are on the decline and the United States expects Social Security benefits to be completely exhausted by 2037. Since no one is planning retirement for us anymore, we need to take the initiative to plan it ourselves. And, there’s no better place to start than with an IRA, where you have complete control over your savings.

Traditional vs. Roth IRAs

The difference between these two accounts is the tax treatment.

Traditional IRAs

A traditional IRA allows you to make pre-tax contributions, which would lower your taxable income on the year through deductions. While contributions are tax-deductible, all withdrawals from this type of IRA are taxable in retirement. With traditional IRAs, you are unable to make withdrawals until you are 59½.

Additionally, with Traditional IRAs, once you reach the age of 73, you must begin making withdrawals from your account. Think of it this way, the IRS allowed you to hold off on paying a tax on your income, so they are forcing you to withdraw to collect that tax. This required withdrawal is known as a ‘Required Minimum Distribution,’ or RMD. This is calculated by taking the value of your Traditional IRA and dividing it by a life expectancy factor determined by the IRS. Failing to make these withdrawals can result in a 50% tax penalty (Charles Schwab).

Roth IRAs

On the other hand, a Roth IRA is funded with after-tax dollars, meaning that contributions are not tax-deductible. However, qualified withdrawals in retirement are tax-free (yes, you read that correctly). Additionally, Roth IRAs have no required minimum distributions, unlike traditional IRAs.

For Roth IRAs, you are unable to make withdrawals from the account until you are 59½ or until after a 5-year holding period. In other words, all contributions in a Roth IRA have to remain in that account for 5 years and until you are 59½ before you can use them. The 5-year holding period is very applicable to those utilizing catch-up provisions in the later stages of retirement planning.

It is worth noting that Roth IRAs do not have RMDs. In other words, you will never be required to make withdrawals. This is the case for inherited Roth accounts also, as long as they have been in the account for at least 5 years (Fidelity).

Factors to Consider When Choosing Between IRAs

In regards to tax planning, Roth IRAs are preferable if you are currently in a low tax bracket and expect to be in a higher tax bracket later in retirement. This situation likely describes most young people. In this case, you would be paying taxes on your income, then making a contribution to your account. Since you are in a low tax bracket, the tax you pay will likely be a lot less than it would if you were to choose the traditional. Then, in retirement, you get to pull from your retirement accounts without having to worry about taxes.

Another advantage of Roth IRAs is that all contributions can be withdrawn whenever without penalty. This is due to the contribution being post-tax. Also, Roth IRA plans do not have RMDs, which can be a huge plus in retirement. RMDs can boost you into a new income bracket in retirement, which may disqualify you from specific government benefits like Medicare.

On the other hand, it is preferable to use a traditional IRA if you’re currently in a high tax bracket and expect to be in a lower tax bracket in retirement. Contributing to your traditional IRA would lower your taxable income in the current tax year, which would result in savings. Additionally, in retirement, if you are in a lower tax bracket, those withdrawals would be taxed at a lower tax bracket than they would be at your current tax bracket. This means you realize tax savings across the board.

Please consult a trusted tax professional for more regarding your retirement tax planning.

Contribution & Income Limits:

If you are under the age of 70½, you are able to contribute to an IRA every year. However, you cannot contribute more than the annual contribution limit. You are allowed to contribute the lesser of 100% of your earned income or $6,000 as of 2022. In 2023, this limit will increase to $6,500 (IRS). If you are over the age of 50, you are able to make additional catch-up contributions of $1,000.

In addition to contribution limits, there are also income limits regarding individual retirement accounts. In order to make IRA contributions, your taxable income must be under $144,000 as of 2022 and $153,000 as of 2023 as a single filer. If you file jointly, your taxable income must be less than $214,000 for 2022 and $228,000 for 2023. Once you earn greater than these amounts, you are no longer eligible to make IRA contributions (Charles Schwab).

Age Limits

There are no age limits for contributing to a Roth IRA, as long as you have earned income (IRS). This means you can be under 18 and over the age of 70½ and still contribute to a Roth IRA (The Balance).

Early Withdrawal Penalties:

In most instances, a withdrawal made from an IRA prior to 59½ results in the amount being taxed at your income tax rate plus an additional 10% penalty (IRS). This rule is to encourage people not to use these funds only for retirement.

Exceptions:

However, this is not the case for contributions made to Roth IRAs. Since they are after-tax funds, all contributions can be withdrawn without tax or penalty (Schwab). However, you would still have to pay tax on any earnings withdrawn from the account. For example, if you contributed $100 and made an additional $50 in your IRA, you would be able to withdraw the $100 without penalty but not the $50.

There are other exceptions to the early withdrawal penalty:

No Health Insurance

If you don’t have health insurance or have expenses that are not covered by your insurance, you can take penalty-free withdrawals to cover them. To qualify, the expenses must be paid in the same year as the withdrawal, and the expense must be greater than 10% of your adjusted gross income.

Unemployment

If you are unemployed, you can take penalty-free withdrawals to cover health insurance premiums while unemployed. For this, there are various conditions that must be met. You can read Investopedia’s article on the topic here.

Disability

If you are permanently disabled and physically unable to work, you can make tax-free withdrawals. These withdrawals can be used for any purpose. However, you may need to show evidence of the disability.

Qualified Education Expenses

If you are paying for qualified education expenses for yourself, your spouse, or your child, you can do so using penalty-free IRA withdrawals. Qualified educational expenses include tuition, books, supplies, etc. To determine what qualifies as an educational expense, consider discussing more in-depth with a tax professional.

Inherited IRAs

If you inherit an IRA, withdrawals are made without penalty. There are some exceptions to this rule. You can read Investopedia’s article on the topic here.

First-Time Homebuyer

If you are a first-time homebuyer, you may withdraw up to $10,000 over your lifetime from your IRA penalty-free. To qualify, you must not have owned a home in the last two years, meaning you could have been a homeowner in the past and still qualify. It’s worth noting that your spouse can combine their $10,000 limit with yours, making it $20,000 towards your home purchase penalty-free.

SEPP (Substantially Equal Periodic Payments)

If you must make regular withdrawals from your IRA for a few years, the IRS allows it without penalty under certain conditions. You must withdraw the same amount for five years or until you turn 59½, whichever comes first. This is an approach used by those in the FIRE Movement, allowing you to access IRA funds prior to retirement.

IRS Tax Levies

If you are required to pay previously unpaid federal taxes, the IRS can withdraw from your IRA penalty-free. In this case, the IRS must be the one making the withdrawal to avoid penalties.

Active Duty in the Military

If you are a reserve in the military and are called into active duty for at least 179 days, you may make ‘qualified reservist distributions’ without penalty.

How much money do you need to open a Roth IRA?

Nowadays, many providers don’t require a minimum balance to open a Roth IRA account. For example, the following brokerages have no account minimums or fees: Fidelity Investments; Merrill Edge; Charles Schwab; TD Ameritrade; and TIAA-CREF.

Just be careful. Although there isn’t an account minimum, the banks may look to charge you elsewhere. They might charge an inactivity fee if the account is dormant or maintenance fees to hold the account. So, make sure you read the fine print.

Can You Open an IRA at Any Bank?

Roth IRAs can be opened at most banks, credit unions, brokerage firms, and online investment platforms. However, not all institutions offer IRAs, so it’s important to do your research and find a provider that offers the investment options and services you’re looking for.

When choosing a provider, it’s important to compare fees, investment options, and customer service. Some providers may charge high fees for account maintenance or investment management, while others may offer lower fees but fewer investment options. It’s also important to consider the level of customer service and support provided by the provider.

Where should I open my IRA?

When choosing a provider for your IRA, consider factors such as fees, investment options, and customer service. Some popular IRA providers include Vanguard, Fidelity, and Charles Schwab.

Providers may charge fees for account maintenance, investment management, and other services. Be sure to compare these fees across different providers to find the best option for your needs. You should also consider the investment options available through each provider, including stocks, bonds, and mutual funds.

Ultimately, the best provider for your IRA will depend on your personal preferences and investment goals. Do your research and compare different providers to find the option that offers the services and investment options that align with your needs.

Steps to open an account

To open an IRA, you will typically need to provide personal identification information, such as your Social Security number, and financial information, such as your income and employment status. You will also need to choose your investment options and make an initial deposit to fund your account.

How Much Should I Put in My IRA?

The amount you should contribute to your IRA depends on your retirement goals and the amount of time you have until retirement. As a general rule of thumb, financial experts recommend contributing at least 15% of your income to your retirement savings. If you are able to contribute more, I’d consider doing so. You can never save too much for retirement.

If you are unable to contribute that much, it’s important to contribute what you can and increase your contributions as your income grows. Everything counts, no matter how small the investment. Just to emphasize this, every dollar invested at age 20 would grow to $73 by the time you retire. In other words, just investing a couple of dollars in your early 20s can balloon 70 times over by retirement. So, keep that in mind when you think you might not have enough to retire. There’s never such a thing as not having enough money to start planning retirement.

To calculate your specific contribution amount, consider your retirement goals and estimate the total amount you will need in retirement. Divide that amount by the number of years until you plan to retire and then divide by 12 to get your monthly contribution amount. Keep in mind that the annual contribution limit for Roth IRAs in 2023 is $6,500, or $7,500 if you are age 50 or older.

The Benefits of Maxing Out Your IRA

Contributing the maximum amount to your IRA each year can have a significant impact on your retirement savings. As noted above, even small contributions have huge growth potential. Imagine the growth potential for a maxed-out IRA!

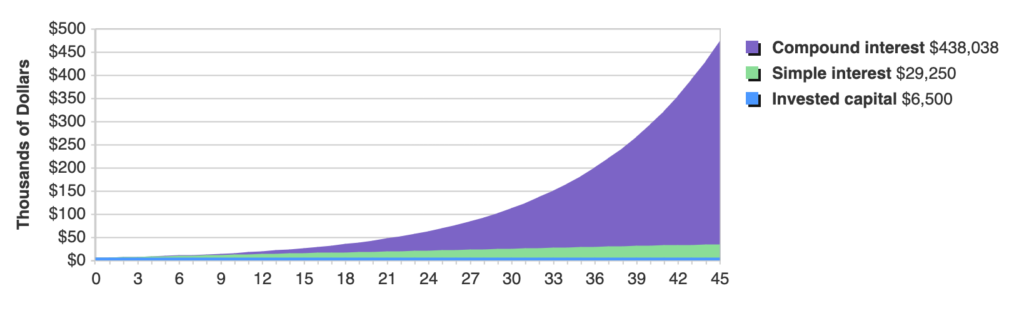

If you maxed out your IRA at 20 and never touched it again, you would retire with over $473,000 in savings. In this scenario, you would’ve only contributed $6,500, receiving over $438,000 in compound interest. Now that’s impressive growth, and this is only considering a one-time investment in your IRA. What if you maxed out your IRA every year?

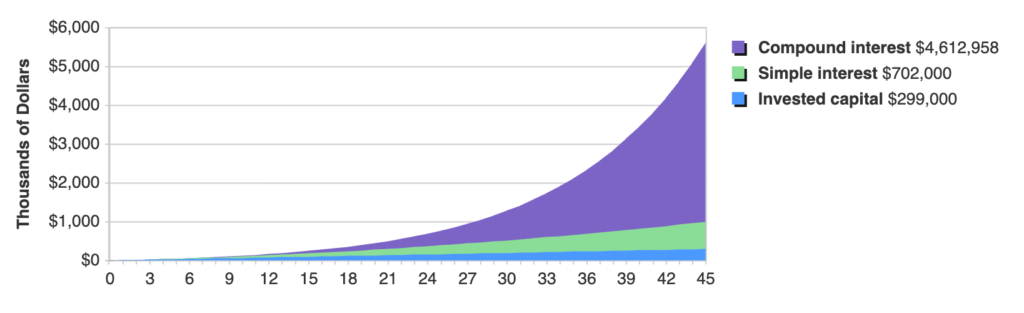

If you maxed out your IRA every year until retirement, you would retire with $5.6 million in savings. Of that amount, you only contributed $299 thousand, meaning $4.6 million came from interest alone. That is crazy! At that point, you’d likely be able to retire comfortably and not have to worry about finances in retirement.

Over time, the potential for compound interest can help your investments grow substantially. It’s important to also consider the impact of investment returns on your retirement savings. While there are no guarantees when it comes to investing, a diversified portfolio can help mitigate risk and increase potential returns.

How Budgeting Can Help Your Retirement Planning

Now that you see the benefits of maxing your IRA, you might want to know how to do so. Since there is a limit on how much you can contribute to your IRA, you already have a yearly goal to plan for. So, to max out your IRA, you could look to make regular monthly contributions. In that case, you would need to contribute about $540 a month ($6,500 / 12 months).

If you currently are unable to contribute the recommended amount to your Roth IRA each month, there are strategies you can use to increase your contributions. These include budgeting, reducing expenses, and increasing your income through a side job or negotiating a raise.

If you also have a lump sum of cash available (through savings or a bonus for example), you could make one large contribution to max out the IRA. It is all up to your personal preference. I personally feel that the monthly contributions are easier to follow.

Is There Risk Investing in an IRA?

The main risk associated with an IRA is the potential for the investments to lose value. But, this is a risk for all investing. This is not unique to IRA plans. All investing involves risk, and investing in an IRA is no different. However, the risk level can be managed through diversification and risk management strategies.

It’s important to remember that the stock market has historically trended upward over time, and a long-term investment strategy can help mitigate short-term market fluctuations. Through the end of 2021, the stock market has increased by over 10% annually. It’s worth noting that this is not unique to IRAs, as all investments run the risk of losing their value.

Diversification and Risk Management Strategies:

Diversification is an investment strategy that involves spreading investments across different types of assets and industries to minimize risk. An IRA can be diversified through investing in different types of funds or assets, such as stocks, bonds, or real estate investment trusts (REITs). Additionally, a risk management strategy such as setting a target asset allocation can help manage risk levels in an IRA.

A great way to diversify your IRA is to use stock market index funds. These funds match the performance of the entire market, which increases your chances of seeing that expected 10% annual return. Note that past performance does not guarantee future results. You can read more on index funds here.

What is better a 401k or an IRA?

A 401k and an IRA are two common retirement savings options, each with its own set of benefits and drawbacks.

The Differences Between a 401k and a Roth IRA:

A 401k is a retirement savings plan offered by employers, while an IRA is an individual retirement account that can be opened by anyone who meets the eligibility requirements. The main difference between the two is the way how you open them. In most cases, you can only open a 401k account through your employer. If they do not offer a 401k plan, then you are unable to open one. On the other hand, as long as you have earned income and meet other requirements, you can open an IRA on your own.

Another notable difference is the investment options. For 401ks, your employer limits what investments are available to you. They may choose select mutual funds and company stock for you to pick from. With IRAs, you can invest in almost anything, from stocks to bonds to index funds to even real estate and cryptocurrency.

Benefits and Drawbacks of Each Option:

One benefit of a traditional 401k is that it often comes with employer matching contributions, which can increase the overall savings potential. Additionally, contributions to a 401k are often made automatically through payroll deductions, making it easy to save for retirement. Automating your savings can make it easier to hit financial goals. However, 401k contributions are subject to required minimum distributions (RMDs) starting at age 72. In other words, at 72, you have to start making withdrawals. Also, another disadvantage is that 401Ks can have limited investment options, as touched on earlier.

On the other hand, a Roth IRA specifically has no RMDs. Additionally, because contributions are made with after-tax dollars, there is flexibility in withdrawing the contributions (not the earnings) penalty-free at any time. Additionally, IRAs have unlimited investment options, as mentioned before. However, there are income limits for contributing to a Roth IRA, and the contribution limit is relatively low compared to a 401k. In 2023, the contribution limit for an IRA is $6,500, while the limit for 401k plans is $22,500. As you can see, there’s a big difference.

It’s worth noting that these are specifically the case for traditional 401k plans and Roth IRA plans. You could also open Roth 401k plans and traditional IRA plans as well. Roth 401k plans are very similar to Roth IRAs. Specifically, they also don’t have RMDs and no penalties on contribution withdrawals. For Traditional IRAs, you are unable to withdraw contributions as freely, and there are RMDs once you turn 73. So, they are similar to traditional 401Ks in that regard.

Factors to Consider:

The decision of which option is better for an individual depends on factors such as income level, age, and retirement goals. If an employer offers matching contributions, it may be beneficial to take advantage of the 401k to maximize the savings potential. However, if there’s no match given, you might be better suited to go with an IRA due to its endless investment options.

Additionally, if your employer doesn’t offer a Roth option for its 401k plan, the Roth IRA could provide you with better tax treatment too. If you are in a lower tax bracket now and expect to be in a higher bracket in retirement, a Roth IRA may be a better option.

As always, consider discussing this with a financial advisor or tax professional prior to implementation.

Do employers Match Roth IRA Contributions?

Unfortunately, Roth IRAs do not have this benefit. Employer matches are common with 401K plans. Since IRAs are open by individuals (not employers), there typically is no employer to make a match. This is one of the biggest advantages that a 401K plan has over IRAs.

Bottom Line on IRAs

IRAs are fantastic vehicles for retirement planning. They allow you to take advantage of tax benefits and provide you the freedom of choice when it comes to investment decisions. It is important to reiterate some of the downsides, which are RMDs, income limits, contribution limits, and early withdrawal penalties. However, I’d argue that the pros of these accounts far outweigh the cons.