Recently, I’ve seen many people on Twitter, TikTok, and other social media pushing the idea that 401ks are scams. In my opinion, that can’t be any more wrong. Do 401Ks have drawbacks? Of course. There are limited investment options, contribution limits, potential fees, and an age limit for when you can start making withdrawals. However, generalizing 401Ks as scams are simply misguided and incorrect.

401Ks are Regulated

Firstly, unlike actual scams, 401K plans are regulated by the US government to protect employees. The Employee Retirement Income Security Act (ERISA) and the Internal Revenue Service (IRS) oversee 401K plans to ensure that the fees charged are reasonable and that the plan’s investments are managed in the best interests of the participants.

To be more specific, the ERISA outlines various requirements for employers that offer 401K plans. These requirements include providing plan information, minimum standards for participation and funding, fiduciary responsibilities for the employer, the right for participants to sue for benefits and breaches of fiduciary duties, and more.

Merriam-Webster defines a “scam” as a fraudulent or deceptive act or operation. Unlike Ponzi schemes, crypto pump-and-dumps, and other actual scams, 401Ks are subject to federal regulations to ensure they are not fraudulent or deceptive. So, by definition, 401Ks are not scams.

The Matches are Great

In addition to not being a literal scam, 401Ks also provide tremendous benefits that aren’t offered by other investment options. This is most evident with employer matches. Often, 401K plans offer a matching contribution from the employer, which can significantly increase the amount of savings an employee has in retirement. Receiving these matches is ultimately getting free money for your retirement.

Let’s go through a quick example: let’s assume that a company has a matching program, where if an employer contributes 6% of their check, the company will pay an additional 3%. If an employee, who makes $100,000, contributes 6% of their salary ($6,000), then the employer would contribute an additional 3% ($3,000) on their behalf. In other words, having an employer match is free money towards your retirement, making it extremely powerful for your retirement planning.

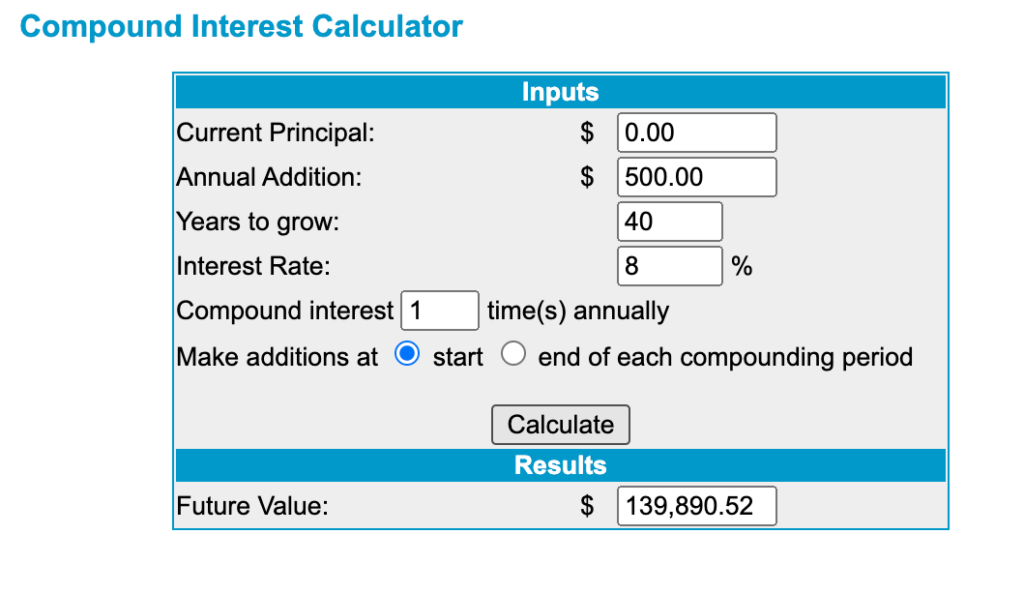

In my opinion, this is the most powerful benefit offered by 401Ks. Especially when you are young and don’t have a high income, getting an additional boost in your savings can make a world of difference later in life. With compound interest, employer matching contributions early in your career can potentially fund significant parts of your retirement. With free money towards your retirement, how are 401ks scams?

401Ks Have Incredible Tax Benefits

In addition to employer matches, 401K plans also offer tremendous tax benefits. Much like IRAs, the tax advantages of a 401K depend on the account type: Roth or traditional.

A traditional 401K plan allows you to make pre-tax contributions, which would lower your taxable income on the year through deductions. While contributions are tax-deductible, all withdrawals from this type of IRA are taxable in retirement. With traditional IRAs, you are unable to make withdrawals until you are 59½.

A Roth 401K Plan is funded with after-tax dollars. In other words, all contributions are not tax-deductible. However, qualified withdrawals in retirement are tax-free (yes, you read that correctly). This means that all income/gains realized in these accounts are not subject to tax.

To learn more about the benefits offered by 401Ks, read my Ultimate Guide to 401K Plans here!

401K Plans = Convenient Retirement Planning

Additionally, 401K plans aren’t scams because they offer a convenient way for employees to save for retirement. Once set up, your employer automatically deducts the contributions from your paychecks. This can make the retirement planning process simple, as it takes out steps that are required for IRAs and other retirement vehicles.

The automation of your retirement planning increases your chances of a comfortable retirement. It encourages dollar-cost averaging, or consistent investing. This behavior improves your ability to see the highest returns on your investment.

Not All 401K Plans are Limited

While 401Ks can be limited in terms of investment options, some 401K plans can offer great flexibility. No two plans are the same. Some 401k plans can offer a wide variety of options, including stock funds, bond funds, REITs, etc., while others don’t. So, to paint all 401K plans as scams, for this reason, is rather misguided.

Even if your 401K plan is limited, you could always bring up your concerns with your employer to try to change it. You could do some research into other 401K plans and make suggestions to see if your employer is willing to make a change. You’d be surprised to see how willing they’d be to receive this feedback.

You can also argue that having limited options is a positive. Having unlimited options can be overwhelming for those just starting out. For example, with an IRA, you are able to invest in practically anything (stocks, bonds, real estate, even crypto). But, investing in these different things without understanding what thought should go into it can be dangerous. So, in a way, having only a few reputable mutual or index funds available as options can serve as training wheels. This ensures you don’t do anything too risky, like spending all of your retirement savings on an NFT.

The Minimum Withdrawal Age Is There for a Reason

Lastly, the biggest criticism of 401Ks (and other retirement plans) is that the age of withdrawals (59½) is too old. Many may think: “I don’t want to retire so late. Why should I be living my life to the fullest at such an old age?” While I understand the idea behind this, I also think this isn’t correct. The reason for this age requirement is to ensure younger adults do not waste their retirement savings. Having this requirement and an early withdrawal penalty makes it so you keep the money in your account until you retire. Nothing is worse than having your retirement in jeopardy due to a lack of planning.

And, as mentioned earlier, there are numerous exceptions that allow you to make early 401K withdrawals without penalty. So, even if you had a reason to touch your savings, you could with no penalty.

The Minimum Withdrawal Age Isn’t Even That Old

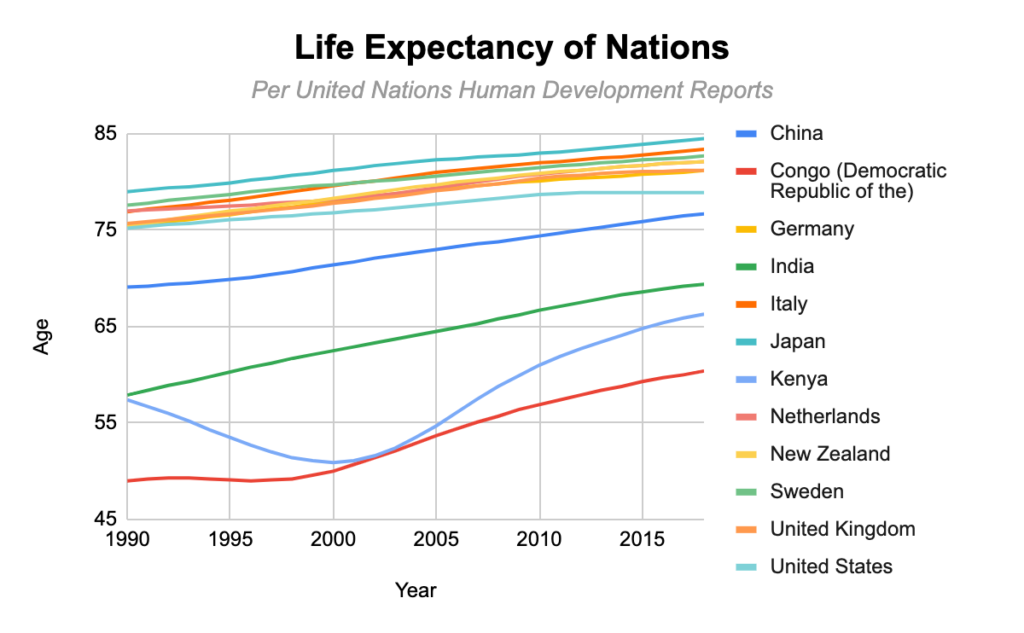

Additionally, 59½ is not all that old. According to the CDC, the average lifespan in the US is 76.4 years old. That means, if you retire at 60, you will have over 15 years of retirement as of today. As technology advances, I’d expect this life expectancy to increase, meaning retirements will only become longer. This means your quality of life at an older age will likely not decline as dramatically as it does today.

Again, I do understand the argument. Working for 40 straight years of your life might seem a little overboard. But, saying 401ks are scams isn’t the truth. To ensure a safe retirement, there is no better retirement vehicle than a 401K. It offers you preferential tax benefits and potential employer matches. While working for four decades might seem like a lot, what if you had to work even longer because you never took retirement planning seriously? There is no better (or more tax-efficient) alternative for your future than a 401K.

Bottom Line – 401Ks Are Not Scams

Against what people say on social media, a 401K plan is one of the best ways to plan for your retirement. It provides you with tax benefits and possibly free money towards your retirement. Being able to have a safe and comfortable retirement should be a priority for everyone. And, choosing not to use one of the best retirement plan options would make achieving that very difficult.

If someone’s advice is to not use a 401K plan, stay as far away from them as possible with your finances. In my opinion, this person should lose all their credibility when it comes to financial advice. They likely are either misinformed or scam artists. (The scam artists typically bash retirement planning so that you purchase one of their products. This might be life insurance that you don’t need or some course that provides absolutely no value.)

Whatever it may be, please be cautious when hearing unlicensed individuals on social media giving financial advice. Whether misinformed or lying intentionally, they are spreading harmful information that could prevent you from having the safe and comfortable retirement that you deserve.