In 2019, over 16,000 stores closed their doors in the United States. With so many retail bankruptcies, many expect the trend only to continue, as retailers are still struggling. Some have coined this decline as the ‘retail apocalypse,’ seeing it as the beginning of the end for brick-and-mortar due to the internet.

While e-commerce has definitely disrupted the industry, brick-and-mortar retail still has a place in today’s economy. However, simply providing products is no longer an acceptable business model to be a successful retailer. Today, any person can buy retail products online in the comfort of their own home. So, companies must give a different reason for customers to visit their physical locations, and failing to do so will leave retailers in the dust. There are a number of ways that brick-and-mortar locations can provide value to customers. They may seem simple, but they are an effective means to survive the dreaded ‘retail apocalypse.’

Providing Experiences to Customers

The first and most effective way to survive the ‘retail apocalypse’ is through offering an experience to customers. In other words, offer an experience that a customer cannot have behind a computer screen. Let’s take a look at a great example: TJX Companies, the parent of TJ Maxx, Marshalls, and HomeGoods. Here is an excerpt from the company’s 2021 Annual Report:

“Our opportunistic buying strategies and flexible business model differentiate us from traditional retailers. We offer a treasure hunt shopping experience and a rapid turn of inventories relative to traditional retailers. Our goal is to create a sense of excitement and urgency for our customers and encourage frequent customer visits.”

Shopping at TJ Maxx isn’t an errand to run; it is an exciting experience that makes customers want to visit their locations. Online shopping cannot replicate this experience, which has benefited TJ Maxx. In 2022, the company reported net income of $3.28 billion, which is a 25% increase from 2018.

Other retailers have utilized partnerships to provide similar in-person experiences. Macy’s, for example, partnered with reselling company ThredUp in an attempt to replicate the TJ Maxx experience in their stores. Target has partnered with the likes of Toys R Us and Ulta for a shop-in-shops store format. These strategic partnerships have helped Target reach its goal of providing an immersive experience in its stores.

There are also companies like TopGolf and Bowlero that provide experience-based services to customers. TopGolf, which was acquired by Callaway for $2.6 billion in 2021, offers a fun twist on a classic driving range. Bowlero, a publicly-traded company, is the world’s largest bowling operator, serving 26 million guests at over 300 US locations. Both companies have seen success over the last several years, as consumers have sought for in-person entertainment to escape their computer screens.

In a market where consumers are spending more time online shopping, retailers have to think of reasons to make them want to come to their businesses. By providing unique in-person experiences, retailers could stand a chance in a tech-driven environment.

Creating Strong Brand Loyalty

In addition to providing experiences, companies can capitalize on their brand loyalty to survive the retail apocalypse. Let’s just take a look at Vineyard Vines.

Vineyard Vines does not only sell apparel; it sells a lifestyle. When a customer buys clothing with that whale logo, they are also buying its philosophy of “living the good life.” This branding and messaging have really resonated with its customers, resulting in tremendous brand loyalty.

The loyalty is so strong that Vineyard Vines has actually been increasing its physical presence. According to USA Today, Vineyard Vines has over 100 US locations and sells its products in over 600 department stores. In 2018, 55% of their sales comes solely from these stand-alone stores.

Founders Shep and Ian Murray see physical storefronts as a great way to promote brand awareness. “If I don’t have a store on your street, you’re not going to think about us,” Shep says. “When we open a retail store in a location, our online business goes up dramatically.” While retailers drop left and right, Vineyard Vines has seen tremendous success with physical brick-and-mortar locations. In 2016, the company saw $476 million in revenue and was valued at $1 billion by Goldman Sachs.

“Our products are like jerseys that say you’re a member of the Vineyard Vines community… We don’t believe we’re in the clothing business. We’re in the brand business.”

Ian Murray, Co-Founder of Vineyard Vines

The Murrays believe brand loyalty is the reason for their success. They also attribute a lack of loyalty to the decline of other similar retail brands, like Tommy Hilfiger and Ralph Lauren. Marshal Cohen, chief retail analyst at NPD Group believes that they “struck a chord with a generation of shoppers when [other retailers] lost momentum” and that “it’s a lifestyle brand like Apple is a lifestyle brand–you buy their clothes, you commit to the whole portfolio.”

Other companies, like YETI, have found similar success by becoming lifestyle brands as well. If you boil it down, YETI’s sole business model is selling coolers. However, that is not what keeps them relevant. The image that they sell with their products allows them to mark up their products to a ‘luxury’ price point. The company has become a full-on lifestyle brand, selling merchandise along with its core products. In 2021, the company realized net income of over $210 million, a 37% increase year-over-year and a 13,000% increase from 2017.

Ultimately, the companies prioritize selling their brand over their products and found tremendous success doing so. In the case of Vineyard Vines, that success came as a result of utilizing physical stores, while competitors have been rushing to close theirs. This business model demonstrates that traditional retailer methods are not obsolete. Brand loyalty can serve as an effective means to remain relevant while e-commerce continues to grow.

Offer Necessities

If retailers can’t make customers want to come to their store, then they could force them to come out of necessity. Some items, such as groceries, cannot be purchased online as effectively as in person. Yes, some companies provide the option to ship groceries to your home, but this does not eliminate the need for physical grocery store locations. The business models of companies like FreshDirect and Instacart still require brick-and-mortar food locations for their deliveries. So, for the time being, providing necessities like food to consumers provides protection from e-commerce.

This is evident in Amazon’s acquisition of Whole Foods. In 2017, the e-commerce giant purchased over 500 of its locations for $13.7 billion, making it the biggest acquisition in Amazon’s history. In order to provide groceries to Amazon customers, the company decided to utilize brick-and-mortar locations.

Ultimately, groceries and other necessities have a wide moat when it comes to fending off e-commerce competition. As a result, grocers demonstrate that it is still feasible to operate on a mortar business model and thrive.

Learning from Victims of the Retail Apocalypse

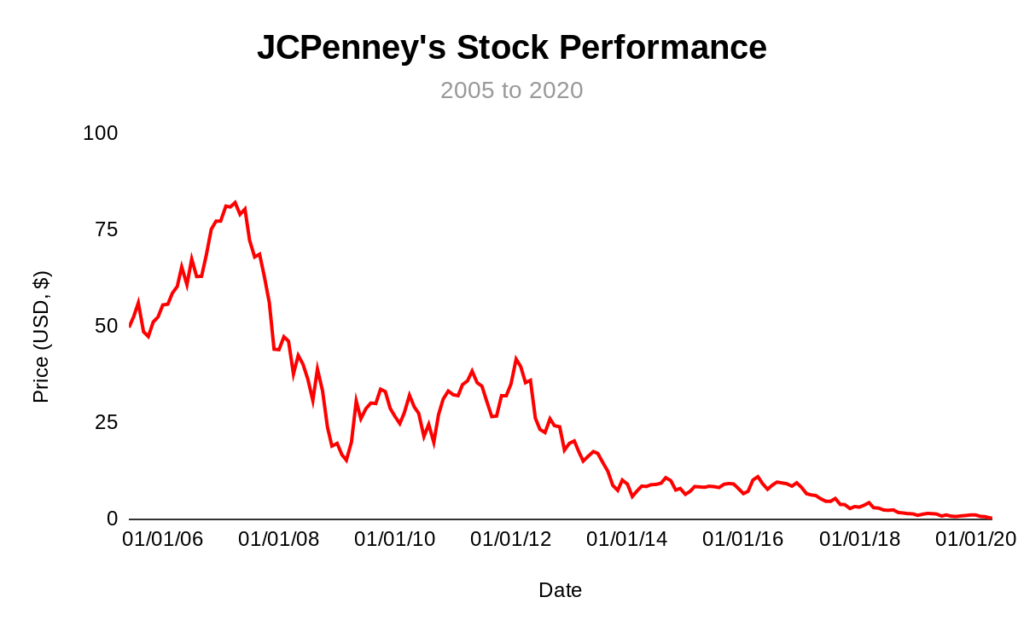

Now that I outlined ways for brick-and-mortar to succeed, let’s look at why so many in-person retailers have failed. It’s easy to say that Amazon is the reason behind the retail apocalypse, but that does not tell the whole story. Former conglomerates like JCPenney, Sears, and Kmart played a large part in their own downfalls. In fact, it’s fair to say that their poor management is the direct cause of their declines. Let’s just look at JCPenney, a company that has seen its stock price dwindle 99% over the last 15 years.

For over a decade, leadership severely mismanaged the company. In 2012, a new CEO, Ron Johnson, was chosen, and he made radical changes to the company. As a former Apple exec, he looked to implement the Apple Store layout for JCPenney stores. He changed the logo and branding of the company to “JCP.” Also, Johnson removed discounts and deals from store locations.

As you could imagine, this strategy was a disaster. The new layout deterred its core demographic: middle-class families. The company tried to appeal to a broader, younger demographic unsuccessfully. Further, abolishing discounts was a turnoff for a department store, which would normally use deals to compete with other retailers. Additionally, loyal JCP customers, who loved the exclusive brands, were deterred, as the company no longer emphasized them. Lastly, the greatest mistake was that this layout was never tested, which is astonishing. How can a company make an across-the-board transformation like this and not have a single test done? This was doomed from the start, which led to Johnson’s dismissal in 2013.

That wasn’t the end of the mismanagement. In 2015, the company hired Marvin Ellison, a former executive of Home Depot, as its CEO. Ellison’s first initiative was to start offering appliances to capitalize on the demise of Sears. In retrospect, it probably was not the best idea to follow the business model of a bankrupt company. JCPenney was never known for appliances and offering them only further deterred any loyal customers it had left.

Overall, years of mismanagement played a critical role in the fall of JCPenney. While it did try to adapt to the market, every attempt was very poorly executed. This poor management contributed to these companies ruining their brand image and their customers’ loyalty. This is in addition to these retailers doing nothing to differentiate themselves from e-commerce competition. This would ultimately aid Amazon in taking down the company.

Bottom Line on the Retail Apocalypse

With retailers dropping dead left and right, many think it is inevitable that e-commerce companies (like Amazon) just continue their dominance and render brick-and-mortar obsolete. Although the situation may seem bleak, that simply isn’t the case. Many of the victims of the retail apocalypse failed due to their own mismanagement. It’s rather lazy to place all the blame on Amazon, when brick-and-mortar stores played their fair share in their own declines.

Ultimately, there definitely is still a place for brick-and-mortar in our economy. This article alone has showcased numerous successful companies that rely on brick-and-mortar locations. E-commerce and online shopping cannot replicate all aspects of physical stores. As a result, brick-and-mortar businesses can provide certain benefits to consumers that e-commerce cannot.