Consumerism is a critical part of the American identity, which is seen in citizens’ spending habits. Americans consume at rates significantly higher than those of foreign countries. This can be seen in the demand for bulk discount stores and storage facilities. Costco, the second discount store in the world, has 558 of its 803 locations in the United States alone. In other words, America consumes so much that it necessitates being able to buy in larger quantities. Americans buy at such great rates that they have nowhere to store their purchases. This results in storage units being commonplace in the US, as 90% of storage units in the world are located in the United States.

Consumerism in the US is likely the byproduct of the country being one of the world’s largest economies. The country has many businesses selling products and many citizens looking to buy those products. (Even though recent store closures might suggest otherwise.) Despite the size of the economy, this consumer-first mindset of Americans means that they contribute to the country’s success without benefiting from it.

Due to financial illiteracy, many Americans spend at high rates that they cannot afford. As a result, their spending is done at the expense of personal savings and investments. So, many individuals will be unable to generate long-term wealth due to very poor spending habits.

Just How Bad Are American Spending Habits?

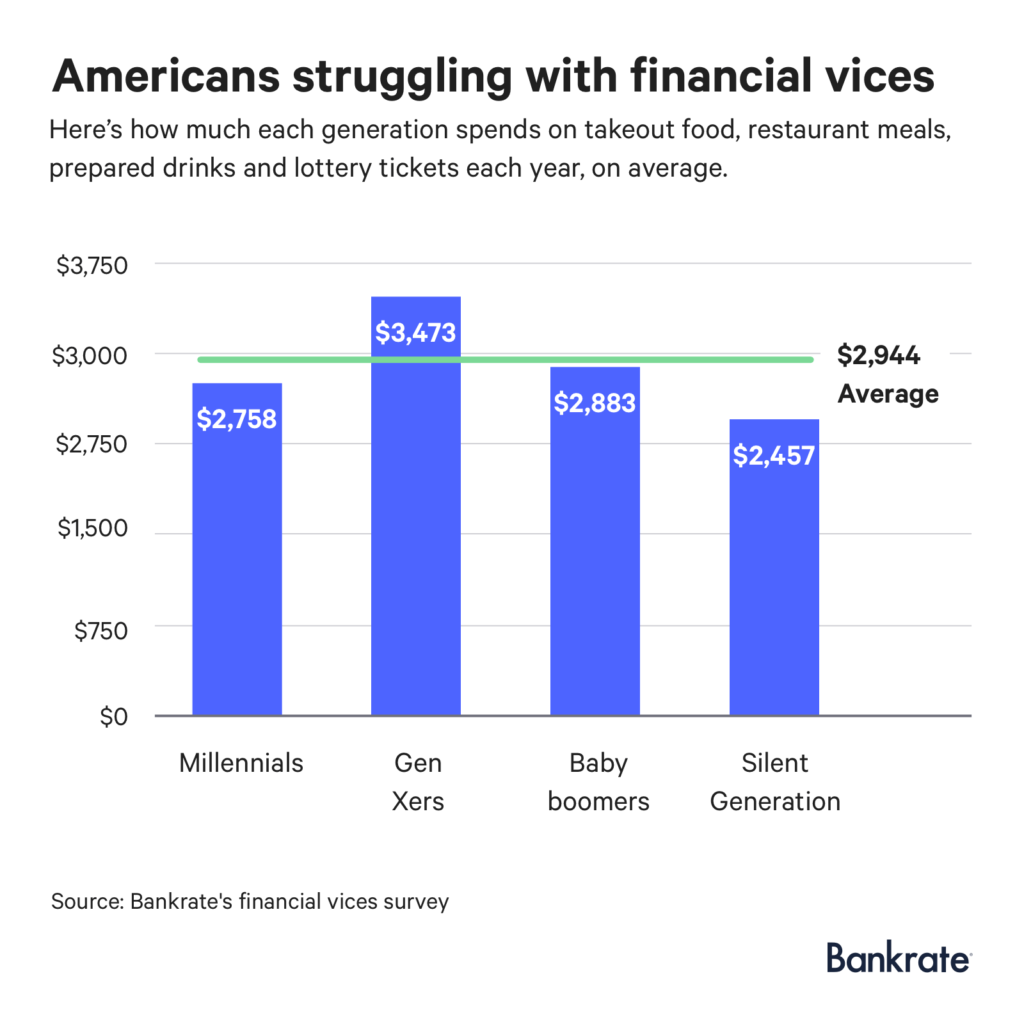

According to a Bankrate survey, the average American buys takeout or goes out to eat 2.4 times a week. Americans also purchase prepared beverages 2.5 times weekly on average. At first glance, this might not seem like the end of the world. But, while some may see dining or getting a coffee as a harmless habit, it comes with a hefty price tag. Adding context to the situation demonstrates how bad the situation truly is.

Of American households, 19% spend more than their actual income, while 34% break even. That is more than half of all US households! Knowing this, going out to eat almost three times per week may not seem as harmless of a habit.

Missed Financial Opportunities

Let’s take a look at how Americans could utilize these funds elsewhere. For restaurant purchases, Americans on average spend $2,443 annually, with 38% of households eating out three times weekly. These types of purchases seem insignificant, but, over the course of a year, these small purchases definitely add up. If Americans went out to eat half as frequently, they would realize over $1,000 in savings.

With so many spending as much as or more than their income, this $1,000 could go a long way. If these individuals were to invest these savings annually into the stock market over a forty-year period, they would have a portfolio worth over $98,000, with under $6,000 being from contributions.

When Americans go out to eat, they often do not realize the opportunity cost of doing so. By doing this, they miss out on investing that money and realizing tremendous growth in its value. This could be a great way to accumulate wealth, but many people do not take advantage of this. For some, this might not be too great of an issue. If they are middle-to-upper-class, they may not face socioeconomic hardships. However, these poor spending habits can harm the bottom of the economic hierarchy tremendously.

And The Numbers Only Get Worse…

While in worse financial situations, lower-income Americans spend at a much higher rate than their higher-income counterparts. Households earning less than $30,000 annually spend 13% of their income on financial vices. This is while households earning greater than $75,000 spend only 2.6% of their income on these vices. Further, it appears that the less a low-income person earns, the more they actually consume. Those making below $15,000 in annual income expend over $26,000 yearly. This means that these individuals go into debt for their yearly expenditures.

This is also the case for higher income brackets. According to the Bureau of Labor Statistics, those who earn between $15K and $30K spend over $34K annually. Further, those making between $30K and $40K spend over $40K annually. These statistics are rather startling, as they demonstrate how many Americans are living beyond their means. This is evident in the categories in which low-income individuals spend their money most. For those earning below $15,000, 3.3% of expenditures are dedicated towards apparel, the largest percentage for any income bracket.

It appears that these poor financial decisions result from financial illiteracy. Those in these lower-income brackets are more likely not to have graduated from or even attended high school. A lack of formal education is a rather good indicator that these individuals never received any exposure to financial topics. Without proper financial literacy, these individuals may not understand the ramifications of their overconsumption and the consequent missed financial opportunities.

Companies Prey on Poor Spending Habits

As just outlined, Americans, especially those in lower-income brackets, spend rather recklessly. This behavior leaves them vulnerable to companies to prey on their ignorance. Unfortunately, this is exactly what happens.

Many institutions and corporations recognize this phenomenon and take advantage of the situation by targeting low-income individuals. This is most evident in the lottery and gambling industries.

The Lottery & Gambling

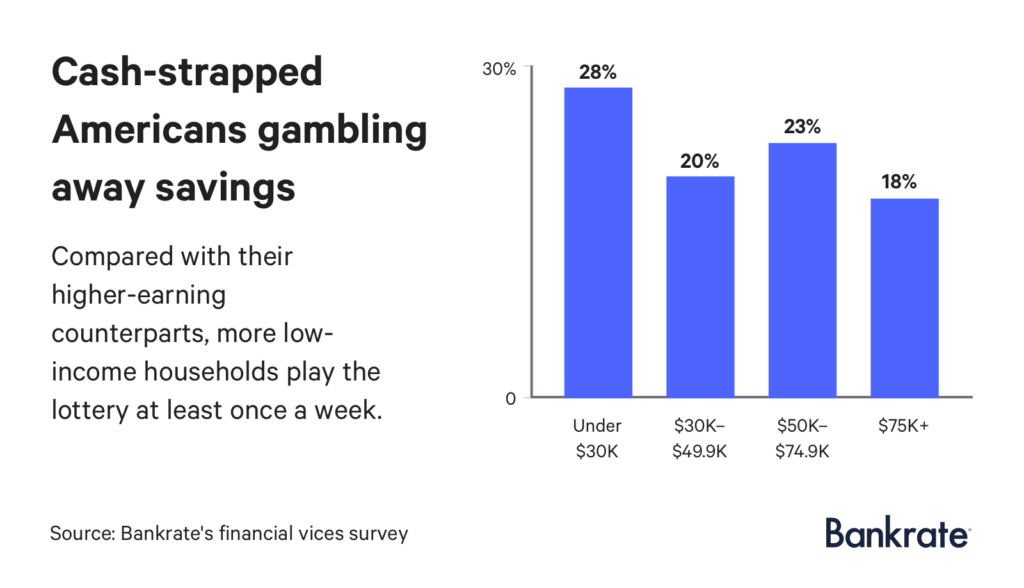

Overall, Americans play the lottery at a very high rate, spending $17 on average weekly. However, lower-income individuals purchase lottery tickets more so than those earning greater incomes. Of lower-income households, 28% play the lottery at least once a week. In contrast, only 19% of higher-income households play it weekly. Overall, lower-income households spend $412 annually on lottery tickets, which is four times greater than the highest-income households.

Purchasing lottery tickets is essentially throwing away money. Purchasers have 1 in 292.2 million odds of winning the lottery. With those odds, there is a better chance of getting killed by a falling asteroid than winning. If the odds are so slim, why do so many continue playing?

Those in lower-income brackets likely are looking for any means to improve their financial standing, even if that means playing your odds at an impossible game like the lottery. According to the Consumer Federation of America, 21% of Americans and 38% of those earning less than $25,000 believe that winning the lottery is the only way for them to accumulate hundreds of thousands of dollars.

In addition to the lottery, lower-income and less-educated individuals look to more literal forms of gambling to accumulate wealth. The University of Buffalo found that individuals in impoverished neighborhoods are twice as likely to gamble than those in more affluent areas.

With the rise of the internet, gambling has become more accessible to millions of Americans as a result of being online. From 2019 to 2020, the online gambling market grew from $58.9 billion to $66.7 billion, and it is expected to grow to $92.9 billion by 2023. This suggests that even more individuals are likely to partake in gambling as the main source of generating wealth. Gambling is not a fruitful approach to accumulating wealth. In fact, it is almost a certainty that long-term gambling will lead to losses. The gambling and lottery industries are completely aware of this and benefit from financially illiterate individuals unknowingly throwing their money away with these habits.

The Harms of Gambling

The lottery system and the gambling industry knowingly prey on the vulnerability of low-income and financially illiterate Americans. One could start gambling with good intentions, namely in an attempt to improve their financial standing. However, this is how these companies rope people in. Gambling is intrinsically addictive. Roughly 3 million Americans suffer from gambling disorder, which is when one gambles excessively and compulsively.

There are a number of negative effects when it comes to gambling, stretching past financial harms. In addition to possible bankruptcy, according to the Mayo Clinic, excessive gambling could result in relationship problems, declining work performance, and deteriorating physical and mental health.

It is upsetting to see how gambling has been on the rise over the last few years. Sports betting, in particular, has experienced a renaissance of sorts. Once a taboo topic, sports betting is advertised on national television. There are gambling companies that are major sponsors for sports leagues, like the NFL. ESPN and other sports broadcasting companies even have entire shows on the topic of gambling. This phenomenon is exposing a much younger demographic to gambling for the first time. Younger adults are now at risk of falling victim to gambling addiction and its life-long consequences. (Studies have shown that younger individuals are 2-7 times more likely to become addicted to gambling than adults).

Too many individuals do not grasp a basic understanding of personal finance. Consequently, they are more individuals susceptible to falling victim to these industries. If more were financially literate, fewer would look to gambling to improve their financial situation. Instead, they may look to safer and more effective methods, like investing and saving.

Credit Card Companies

These poor spending habits can also result in other harmful behaviors, such as reckless use of credit cards. Many individuals are likely to utilize a credit card for their spending. This is not bad in itself. I am an advocate of responsible credit card use. However, not everyone uses their credit card responsibly. In turn, this turns what could be a tremendous financial tool into yet another obstacle Americans have to overcome.

Too Many Don’t Know What a Credit Card Even Is

This is demonstrated best among college students. According to a study, 43% of college students cannot differentiate between a credit card and a debit card. This is concerning as 46% of college students have a credit card, with 36% having $1,000 in credit card debt. It’s clear that too many college students are uneducated about credit cards. This is especially alarming given how many have a credit card, leaving many vulnerable to the dangers of poor credit card use.

The Harms of Uneducated Credit Card Use

Uneducated use of credit cards can lead to significant negative consequences. One of these consequences can be overspending, which reinforces poor spending habits. One study found that individuals spend twice as much when using a credit card instead of cash.

There appear to be some psychological factors when it comes to using a credit card. Users seem not to realize how much they are spending since it does not immediately withdraw from their accounts. On the other hand, when using cash, individuals immediately feel the consequences of their spending. This may make them more reluctant to spend money.

Overspending could result in users accumulating debt and missing interest payments. This would boost these companies’ bottom line, while directly harming the individual. This is because they would likely have to pay greater amounts in the future. For example, missing an interest payment would lead to owing a greater amount for the next pay period. Another example is having to pay a greater interest rate due to a low credit score from poor credit card use.

In the calculation of a FICO score, 35% and 30% of the score are calculated using payment history and amounts owed, respectively. ‘Payment history’ tracks if an individual has paid their debts on time. ‘Amounts owed’ tracks how much debt an individual accumulates within a time period. If an individual utilizes a credit card properly, then they would easily be able to pay their bills on time. However, if one is uneducated about credit cards, it would be easy to miss payments and rack up high amounts of debt. This, in turn, would negatively impact 65% of your FICO score. In this case, it would likely be difficult to be approved for favorable interest rates, if approved for a loan at all. This could impact one’s ability to make more important purchases down the line, like their first home.

In this situation, the individual would have to pay more of their money because their credit card use hurt their credit score. If they were taught how to properly utilize these tools, then they’d avoid making these mistakes and facing the consequences. However, that is not the case, and credit card spending contributes to another unnecessary expense for many Americans.

Credit Card Companies Know This…

Credit card companies are aware of this phenomenon and directly benefit from it. In his book The Total Money Makeover, financial guru Dave Ramsey states that: “debt is not a tool; it is a method to make banks wealthy, not you.” While credit card use can be dangerous, it is only dangerous if it is used improperly. Unfortunately, too many individuals are not educated enough on credit card use to use it properly.

It is in these companies’ best interest for users to use their credit cards improperly. As shown with your credit score, poor use could result in you being trapped in a debt cycle. This would make the user essentially a constant revenue stream for the company, as they would constantly have to make payments to seemingly never-ending debts owed to the company. The user would have to make their regular payments, interest on the debt accumulated/payments missed, and have to pay higher rates for future forms of debt.

The only way to avoid this is to either A) avoid credit cards altogether or B) learn how to properly utilize them. While Dave Ramsey has no problem with it, I am not in favor of telling people to avoid credit cards altogether. Telling others to avoid credit cards overall is simply lazy advice because it is easier to tell someone to avoid something than to teach them how to properly use it. As a result of poor advice like this and the negative reputations associated with them, many people fear using credit cards altogether.

Smart credit card use can be very straightforward. For example, a simple approach to do this would be to use a credit card like a debit card. By doing this, the holder would never spend more than their available funds, meaning they would always be able to pay their bills on time. Additionally, this would prevent the individual from making irrational purchases or using too much credit, which would avoid over-utilization. Just through this simple approach, an individual would be able to build creditworthiness without any significant changes in their typical spending habits.

What are the Consequences of American Spending Habits?

With Americans having such poor spending habits, many consequently neglect important aspects of their personal finances. One of those neglected aspects that I want to highlight is an emergency fund. According to a Bankrate survey, 71% of adults claim that they do not have enough savings to cover more than six-months worth of expenses. According to a 2017 Federal Reserve study, 40% of American adults would be unable to cover a $400 emergency expense (Board of Governors of the Federal Reserve System). An expense of $400 is definitely not a significant amount, yet so many would struggle to pay this amount if it were an emergency. This demonstrates how financially unprepared Americans overall are for an emergency.

Although this is a significant amount of individuals without proper savings, these individuals seem not to be worried. According to that same survey, 62% of respondents claimed that they are either very or somewhat satisfied with their emergency savings. This demonstrates that not only are Americans not saving enough money for emergencies but they are not even aware of this. As a result, many Americans partake in detrimental spending habits at the expense of their own financial well-being. This leads many families to be one emergency away from being in financial ruin without even realizing it.

I’m focusing specifically on an emergency fund here because it can prove crucial to one’s personal financial success.

With the proper amount of savings, one would be able to weather any financial difficulties thrown at them. Thus, an individual would not have to worry about having enough money to cover these expenses. Additionally, an emergency fund ensures that an individual never has to withdraw funds from retirement portfolios or other investment accounts. Consequently, they would be able to allow their investments to grow, which is critical for lower-income individuals to experience upward social mobility.

It would also prevent an individual from having to borrow money or sell personal possessions to cover these expenses. Going into debt in an emergency can be crippling to one’s finances as it can be very expensive due to the interest payments associated. Unfortunately, about 34% of Americans say that they would take out a personal loan, borrow money, or use a credit card to cover a $1,000 emergency expense. If someone is in such poor financial shape that they cannot afford an emergency expense, then they are likely unable to cover interest payments associated with debt. Thus, such borrowing to pay for emergency expenses would only result in greater expenses down the road, which would hinder any changes of an individual experiencing upward social mobility.

So, overconsumption is a serious issue in the United States. As many companies benefit from reckless spending habits, many individuals are left in poor or worsening financial situations as a result. They prevent individuals from improving their financial wellbeings through. Improving financial education in the country would prevent this phenomenon from continuing. Americans would learn not to spend more than their means, allowing them to reap the rewards of positive financial behaviors like proper investing, budgeting, and retirement planning.